Many investors in India face losses when important news events affecting their stocks go unnoticed. By leveraging advanced AI-powered alert systems, investors and advisors can now receive timely updates that help safeguard and enhance their holdings. This guide introduces actionable strategies for anyone overseeing Indian market portfolios, making it easier to implement intelligent, real-time monitoring solutions.

Whether you manage a small personal portfolio or oversee client investments, you’ll discover how AI-powered tools can catch market-moving events before they hurt your returns.

We’ll explore how automated stock alerts India systems actually work in practice and why they’re becoming essential for serious investors. You’ll learn which specific news events most impact Indian portfolios and how smart algorithms can spot these patterns faster than any human analyst.

Finally, we’ll walk through setting up your own AI investment tracking India system and show you real examples of how intelligent news interpretation has helped investors make better decisions in volatile markets.

Understanding AI-Based Portfolio Monitoring in the Indian Market

How artificial intelligence transforms traditional portfolio tracking

Before the advent of automated alert technology, investors needed to manually track stock prices and sift through news reports, often reacting to events only after the fact. Today, AI-driven alerts provide continuous, real-time surveillance of portfolios, instantly notifying users about any movements or trends relevant to their investments and freeing them from manual monitoring.

AI-based monitoring tools rapidly analyze vast quantities of information, including stock prices, market trends, and current news sentiment. This automated process ensures that relevant insights are flagged immediately, offering investors around-the-clock awareness of market shifts—even during off-hours. The transformation becomes even more significant when you consider that Indian markets are influenced by global events, domestic policy changes, and sector-specific developments that can happen at any time.

Automated investment monitoring platforms now offer predictive analytics that can anticipate potential portfolio impacts before they fully materialize. Instead of reacting to market changes after they occur, investors receive early warning signals based on emerging patterns and news sentiment analysis.

Real-time news analysis capabilities for Indian stocks

The speed at which news travels in today’s digital age makes real-time analysis critical for portfolio protection. Indian stock market news alerts powered by AI can process breaking news in multiple languages including Hindi, English, and regional languages commonly used in Indian business reporting.

These systems analyze news from diverse sources:

- Financial publications: Economic Times, Business Standard, Mint

- Government announcements: RBI policy changes, budget announcements

- Corporate filings: Quarterly results, merger announcements

- Global news: Crude oil prices, currency fluctuations

- Social media sentiment: Twitter trends, LinkedIn discussions

The AI evaluates not just the content but also the credibility of sources, the sentiment tone, and historical correlations between similar news events and stock movements. For instance, when the government announces new policies affecting renewable energy, the system immediately identifies all portfolio holdings in solar, wind, and clean energy sectors.

Machine learning algorithms for pattern recognition

Portfolio management AI tools employ sophisticated machine learning models that learn from historical market behavior and continuously improve their accuracy. These algorithms recognize complex patterns that human analysts might miss, especially in volatile markets like India where external factors heavily influence stock performance.

The pattern recognition capabilities include:

| Pattern Type | Application | Example |

|---|---|---|

| Seasonal Trends | Monsoon impact on agriculture stocks | Fertilizer companies before monsoon season |

| Event Correlations | Election results and sector performance | Infrastructure stocks during policy announcements |

| Cross-sector Impact | Currency fluctuations on export companies | IT stocks during rupee depreciation |

| Technical Patterns | Support and resistance levels | Breakout predictions for blue-chip stocks |

These algorithms analyze millions of historical data points to identify which news events typically trigger significant price movements for specific stocks or sectors. The system learns that certain types of RBI announcements consistently impact banking stocks, or how crude oil price changes affect transportation and chemical companies.

Integration with major Indian stock exchanges

AI-powered investment monitoring systems maintain direct integration with NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) to ensure data accuracy and minimal latency. This integration provides several advantages:

The systems receive real-time price feeds, trading volumes, and order book data directly from exchange servers. This eliminates the delays that often occur with third-party data providers. When significant news breaks, the AI can immediately correlate it with actual trading activity to validate its impact predictions.

Smart portfolio notifications leverage this exchange integration to provide context-rich alerts. Instead of simply notifying you that a stock price dropped, the system explains whether the movement aligns with broader market trends, sector-specific news, or company-specific developments.

The integration also enables advanced features like:

- Circuit breaker monitoring: Alerts when stocks hit upper or lower circuit limits

- Volume surge detection: Notifications when unusual trading activity occurs

- Block deal tracking: Monitoring large institutional transactions

- Derivative activity: Options and futures data for comprehensive analysis

This comprehensive integration ensures that automated stock alerts systems provide the most accurate and actionable information for portfolio management decisions in the dynamic Indian market environment.

Key News Events That Impact Indian Portfolios

Political developments and policy changes

Political events shape market sentiment faster than almost any other factor in India. Election results, cabinet reshuffles, and major policy announcements can trigger massive portfolio swings within hours. AI portfolio alerts systems track political news feeds, social media sentiment, and government press releases to identify potential market-moving events before they fully materialize.

Budget announcements deserve special attention since they directly impact taxation, infrastructure spending, and sectoral allocations. Smart automated investment monitoring tools analyze budget speeches in real-time, flagging changes to capital gains tax, dividend distribution tax, or sector-specific incentives that could affect your holdings.

Changes in foreign investment policies, GST rates, or labor laws create ripple effects across multiple sectors. For instance, modifications to FDI limits in retail or insurance can instantly affect related stocks. AI systems excel at connecting these policy dots to specific portfolio positions.

Corporate earnings announcements and quarterly results

Earnings season brings intense volatility as companies report quarterly performance. Indian stock market news alerts become crucial during these periods, especially for tracking surprise beats or misses that trigger immediate price movements.

AI monitoring systems don’t just track your direct holdings – they analyze supply chain connections, competitor performance, and industry trends that could impact your stocks indirectly. If a major steel company reports weak margins, your auto sector holdings might face pressure too.

Management commentary during earnings calls often provides forward guidance that’s equally important as the numbers themselves. Advanced AI investment tracking India tools parse these transcripts for sentiment changes, capex announcements, or strategic pivots that traditional investors might miss.

Economic indicators and RBI monetary policy updates

RBI policy meetings rank among the most watched events for Indian investors. Interest rate decisions affect everything from banking stocks to real estate investments. Smart portfolio notifications track not just the rate decisions but also the central bank’s commentary on inflation targets, growth projections, and liquidity measures.

GDP growth figures, inflation data, and manufacturing indices create market-wide movements that AI systems can anticipate by analyzing economic data releases alongside historical market reactions. Your portfolio’s sector allocation determines how sensitive you are to these macro indicators.

Currency fluctuations deserve constant monitoring since they impact export-heavy companies differently than domestic-focused businesses. AI-powered investment monitoring tools track rupee movements against major currencies and correlate them with your international exposure.

Sector-specific regulatory changes

Banking regulations, pharmaceutical approvals, telecom policy updates, and environmental clearances can make or break sector performance overnight. Automated stock alerts systems monitor regulatory bodies like SEBI, TRAI, and various ministries for rule changes affecting specific industries.

The pharmaceutical sector faces constant regulatory scrutiny from both Indian authorities and international bodies like the US FDA. AI systems track inspection reports, drug approvals, and regulatory warnings that could impact pharma holdings in your portfolio.

Similarly, banking sector regulations around capital adequacy, loan provisioning, or digital payment guidelines can dramatically affect bank stock performance. These regulatory changes often happen with little advance warning, making automated monitoring essential.

Global market movements affecting Indian markets

Indian markets don’t operate in isolation. US Federal Reserve decisions, Chinese economic data, crude oil prices, and European market trends all influence Indian stock performance. News-based trading alerts help investors understand how global events translate into local market movements.

Foreign Institutional Investor (FII) flows respond quickly to global risk sentiment. When global markets face uncertainty, FIIs often reduce emerging market exposure, including India. AI systems track these flow patterns and correlate them with your portfolio’s FII-heavy stocks.

Commodity price movements affect Indian companies differently based on whether they’re exporters or importers. Rising crude oil prices benefit refiners but hurt airlines and paint companies. Portfolio management AI tools map these complex relationships to provide targeted alerts for your specific holdings.

Benefits of Automated News-Based Portfolio Alerts

Instant Notifications for Market-Moving Events

AI portfolio alerts India systems deliver real-time notifications the moment significant news breaks that could impact your investments. These automated investment monitoring tools scan thousands of news sources, press releases, and regulatory filings within seconds, identifying events like RBI policy changes, corporate earnings announcements, merger deals, or geopolitical developments.

When Reliance Industries announces a major acquisition or the government unveils a new policy affecting the banking sector, traditional investors might miss the initial market reaction. Smart portfolio notifications ensure you receive alerts within minutes, often before the broader market fully processes the information. This speed advantage becomes particularly valuable during volatile periods when stock prices can swing dramatically on news sentiment.

The system’s ability to process information in multiple languages, including Hindi and regional languages, makes it especially effective for tracking Indian market portfolio alerts. Whether it’s a Tamil Nadu government announcement affecting regional companies or a Gujarati business publication reporting on textile industry changes, these AI tools capture the full spectrum of market-relevant information.

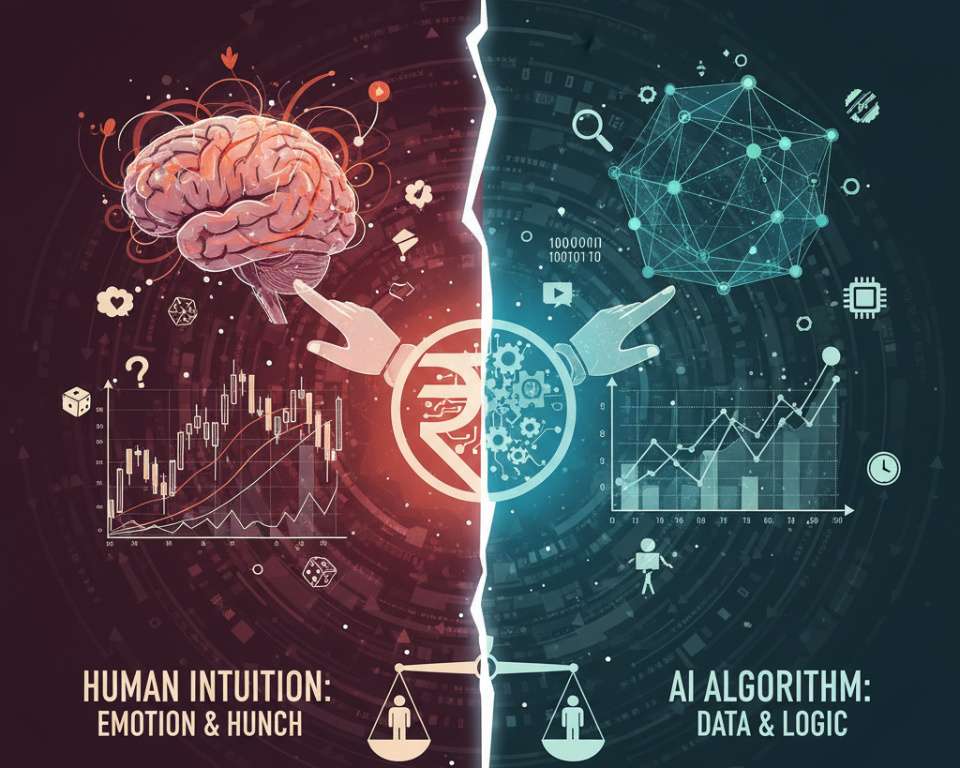

Reduced Emotional Decision-Making Through Data-Driven Insights

Investment decisions are often influenced by emotion, resulting in reactive trades. Automated alert systems counteract this by presenting clear, data-driven guidance based on how similar events have affected stock performance in the past, empowering investors to make informed choices regardless of market sentiment.

Instead of reacting to sensational headlines, investors receive contextual insights about similar past events and their actual market impact. For example, when news breaks about rising crude oil prices, the system might alert you that historically, such events have led to temporary dips in airline stocks but often present buying opportunities for oil marketing companies like HPCL or BPCL.

These automated stock alerts India systems analyze sentiment patterns, trading volumes, and price movements across similar scenarios, helping you make rational decisions based on data rather than emotion. The alerts include probability scores and risk assessments, transforming reactive investment behavior into strategic, informed decision-making.

24/7 Monitoring Without Manual Intervention

Indian markets operate during specific hours, but news that impacts your portfolio happens around the clock. Global events, overnight developments in international markets, and early morning corporate announcements can all influence your investments before you even check your phone.

News-based trading alerts work continuously, monitoring global news feeds, social media sentiment, and regulatory websites even while you sleep. This constant vigilance means you won’t miss critical developments that occur during weekends, holidays, or outside market hours. When Asian markets react to overnight US Federal Reserve decisions or European economic data, your AI investment tracking India system captures these ripple effects and their potential impact on your Indian holdings.

The system’s automated nature eliminates the need for constant manual market monitoring, freeing up your time while ensuring comprehensive coverage. You can focus on your career, family, or other interests while knowing that any significant market-moving event affecting your portfolio will trigger an immediate alert.

Customizable Alert Thresholds for Different Risk Levels

Portfolio management AI tools recognize that not every investor has the same risk appetite or investment strategy. Conservative investors might want alerts for any news that could cause a 2% portfolio movement, while aggressive traders might only care about events potentially causing 5% or greater swings.

These systems allow you to set different sensitivity levels for various holdings. Your blue-chip stocks like TCS or HDFC Bank might have higher alert thresholds since they’re generally more stable, while your small-cap positions could trigger alerts for smaller percentage changes or lower-impact news events.

You can also customize alerts based on news categories – receiving immediate notifications for regulatory changes affecting your banking stocks while setting delayed alerts for general economic news. Geographic customization lets you prioritize news from specific states or regions where your investments are concentrated, ensuring the most relevant information reaches you first while filtering out less pertinent updates.

Setting Up Effective AI Alert Systems for Indian Investments

Selecting Relevant News Sources and Data Feeds

The foundation of any effective AI portfolio alerts India system starts with choosing the right news sources and data feeds. Focus on establishing connections with premium financial news providers like Reuters, Bloomberg, and local powerhouses such as Economic Times, Business Standard, and Moneycontrol. These sources provide real-time market updates, regulatory changes, and corporate announcements that directly impact Indian stocks.

Your automated investment monitoring system should also tap into regulatory feeds from SEBI, RBI, and major stock exchanges like NSE and BSE. Corporate filing databases become crucial for tracking insider trading, board decisions, and financial results. Social media sentiment analysis from platforms like Twitter and financial forums adds another layer of market intelligence.

Consider integrating multiple data feeds to avoid single-point failures. Paid services often provide faster delivery times and cleaner data formatting, making them worth the investment for serious traders. Free alternatives like RSS feeds from major financial websites can supplement your primary sources but shouldn’t be your only option.

Configuring Portfolio-Specific Alert Parameters

Smart portfolio notifications require careful customization based on your investment strategy and risk tolerance. Start by defining trigger conditions that match your trading style. Growth investors might focus on earnings surprises and expansion announcements, while value investors prefer dividend declarations and undervaluation opportunities.

Set up threshold-based alerts for price movements, volume spikes, and volatility changes. A 5% single-day move might warrant immediate attention, while gradual 2% daily changes over a week could signal emerging trends. Sector-specific triggers work particularly well for Indian market portfolio alerts since certain industries like IT, pharma, and banking often move in tandem.

Create different alert priority levels – urgent notifications for major events affecting your largest positions, and informational alerts for broader market movements. This prevents alert fatigue while ensuring you never miss critical developments. Time-based filtering helps too, focusing on market hours for trading alerts while capturing after-hours news for preparation.

Integrating with Popular Indian Trading Platforms

Modern AI-powered investment monitoring systems must seamlessly connect with leading Indian brokerages like Zerodha, Upstox, Angel Broking, and ICICI Direct. Most platforms offer APIs that allow direct integration for order placement and portfolio tracking. This connection enables automated responses to news events, from simple stop-loss adjustments to complex hedging strategies.

API integration also provides real-time portfolio valuation updates, helping your alert system calculate the actual impact of news events on your holdings. When Reliance announces quarterly results, your system can instantly calculate how this affects your portfolio’s total value and sector allocation.

| Platform | API Access | Alert Integration | Auto-Trading |

|---|---|---|---|

| Zerodha | Kite Connect | Yes | Limited |

| Upstox | Developer APIs | Yes | Yes |

| Angel Broking | SmartAPI | Yes | Yes |

| ICICI Direct | Breeze API | Yes | Partial |

Many traders use multiple platforms, so ensure your alert system can aggregate data across brokerages for a unified view of your investments.

Testing and Fine-Tuning Alert Sensitivity

The success of your news-based trading alerts depends heavily on finding the right sensitivity balance. Start with conservative settings and gradually adjust based on performance data. Track false positives – alerts that didn’t lead to meaningful market movements – and true positives that helped you make profitable decisions.

Backtesting becomes essential for AI investment tracking India systems. Run your alert parameters against historical data to see how they would have performed during major events like the 2020 market crash, COVID-related pharma stock surges, or recent tech stock corrections. This analysis reveals optimal sensitivity levels for different market conditions.

Create separate sensitivity profiles for different market phases. Bull markets might require higher thresholds to filter noise, while bear markets need more sensitive alerts to catch rapid deterioration. Earnings seasons, budget announcements, and RBI policy meetings each have unique characteristics requiring specialized alert calibration.

Regular performance reviews should track metrics like alert accuracy rates, response times, and profit/loss attribution to news-based decisions. Successful automated stock alerts India systems evolve continuously, learning from market patterns and improving their predictive capabilities over time.

Maximizing Returns Through Intelligent News Interpretation

Understanding sentiment analysis of news events

AI portfolio alerts India leverage advanced sentiment analysis to decode the emotional undertone of market-moving news. Machine learning algorithms scan thousands of news articles, social media posts, and financial reports in real-time, assigning sentiment scores that range from highly positive to deeply negative. When news about a major Indian conglomerate like Tata or Reliance breaks, these systems instantly analyze not just the headline but the entire context, including expert opinions and market reactions.

The technology goes beyond simple keyword matching. Modern sentiment analysis tools understand nuanced language patterns, sarcasm, and regional linguistic variations common in Indian financial media. They can distinguish between temporary market noise and genuine sentiment shifts that warrant portfolio adjustments. For instance, when news about monsoon predictions affects agricultural stocks, AI systems can differentiate between routine weather updates and significant climate events that could impact crop yields and stock prices.

Smart portfolio notifications become more accurate when sentiment analysis incorporates multiple data sources. These systems cross-reference news sentiment with technical indicators, trading volumes, and historical patterns to provide investors with comprehensive market intelligence.

Timing entry and exit points based on AI recommendations

Automated investment monitoring systems excel at identifying optimal trading moments by processing news events faster than human traders. These AI-powered investment monitoring tools analyze news velocity, market depth, and price movements to suggest precise entry and exit timing for Indian stocks.

The system works by establishing baseline sentiment levels for different sectors and individual stocks. When news breaks that significantly deviates from these baselines, algorithms calculate the probable price impact and recommend action within minutes. For example, if positive earnings guidance from an IT major like Infosys hits the newswires, the AI system immediately assesses similar historical events and suggests whether to buy immediately or wait for a potential dip.

Key timing indicators processed by AI systems:

- News propagation speed: How quickly information spreads across different media channels

- Market reaction velocity: The speed at which stock prices respond to news

- Volume surge patterns: Unusual trading activity that precedes major price movements

- Cross-sector impact: How news about one company affects related stocks

These systems also prevent emotional trading decisions by providing data-driven recommendations. When negative news creates panic selling, AI algorithms can identify oversold conditions and suggest contrarian entry points that human traders might miss due to fear or uncertainty.

Portfolio rebalancing strategies triggered by news alerts

News-based trading alerts trigger sophisticated rebalancing mechanisms that adjust portfolio weightings based on changing market dynamics. Indian market portfolio alerts can automatically initiate rebalancing when significant news events alter the risk-reward profile of individual holdings or entire sectors.

The rebalancing process follows predefined rules while adapting to current market conditions. When regulatory changes affect banking stocks, for instance, the system might reduce exposure to traditional banks while increasing allocation to fintech companies or digital payment processors. This dynamic approach ensures portfolios remain aligned with changing market realities.

Automated rebalancing triggers include:

| Trigger Type | Action | Example |

|---|---|---|

| Sector rotation signals | Shift allocations between sectors | Moving from telecom to renewable energy stocks |

| Risk level changes | Adjust position sizes | Reducing exposure during political uncertainty |

| Correlation breaks | Diversify holdings | Adding defensive stocks during market volatility |

| Momentum shifts | Capitalize on trends | Increasing tech allocation during digital transformation news |

Advanced AI investment tracking India systems also implement gradual rebalancing to minimize market impact and transaction costs. Instead of making dramatic portfolio changes overnight, these systems spread trades across multiple sessions, taking advantage of favorable market conditions and liquidity patterns. This approach helps maximize returns while maintaining portfolio stability during volatile news-driven market periods.

AI-powered portfolio alerts have transformed how investors navigate India’s complex market landscape. By automatically monitoring news events and analyzing their impact on your holdings, these systems help you catch everything from policy changes and corporate earnings to economic indicators that could affect your investments. The ability to get instant notifications about relevant news means you can make informed decisions quickly, whether that’s adjusting your positions or simply staying aware of market movements.

The real power comes from intelligent interpretation of news events specific to the Indian market context. Setting up these alert systems properly – with the right keywords, sources, and risk parameters – can give you a significant edge in timing your investment moves. Rather than constantly checking multiple news sources or missing important updates, you can focus on what matters most while your AI assistant keeps watch. Start small by configuring alerts for your largest holdings and gradually expand the system as you see results.