AI trading bots are gaining popularity among Indian traders who want to automate their investment strategies, but they come with serious risks that could cost you big money. If you’re considering AI trading bots India or already using automated trading systems, you need to understand the potential dangers before they hit your wallet.

This guide is for retail traders, investors, and anyone exploring algorithmic trading risks India who wants to protect their capital while using these tools. You’ll discover the most dangerous pitfalls that catch traders off guard and learn practical ways to avoid them.

We’ll break down the biggest threats you face, including regulatory compliance violations that could land you in legal trouble, technical glitches and system failures that can drain your account in minutes, and the hidden costs that make “free” bots anything but free. You’ll also learn about over-optimization trading bots that look perfect on paper but fail miserably in real markets, plus security vulnerabilities that put your financial data at risk.

By the end, you’ll know exactly what to watch out for and how to use AI trading technology safely without falling into these expensive traps.

Regulatory Compliance Violations That Could Lead to Legal Penalties

Understanding SEBI Guidelines for Algorithmic Trading

You need to know that SEBI has specific rules for AI trading bots India that can’t be ignored. If you’re using algorithmic trading systems, you must comply with their approval process for algorithms. Your trading bot needs prior approval from the exchange before you can deploy it live. This means submitting detailed documentation about your algorithm’s logic, risk management features, and testing results.

Your bot must also include mandatory risk controls like position limits, loss limits, and order-to-trade ratios. SEBI requires these safeguards to prevent market disruption. If your system doesn’t have these built-in protections, you’re violating regulations before you even place your first trade.

You also can’t just set up multiple algorithms without proper authorization. Each strategy needs separate approval, and you must maintain detailed records of all algorithmic activities. Your trading infrastructure must meet minimum system requirements for latency, capacity, and backup systems.

Tax Implications and Reporting Requirements

Your AI trading bot profits aren’t exempt from Indian tax laws. You need to classify your trading income correctly – whether it’s business income or capital gains depends on your trading frequency and holding periods. Most bot trading qualifies as business income, subjecting you to higher tax rates.

You must maintain detailed transaction records for every trade your bot makes. This includes entry and exit points, timestamps, profit/loss calculations, and brokerage fees. The Income Tax Department expects comprehensive documentation, and your automated trading makes this even more critical.

Your reporting requirements extend beyond just profits. You need to account for:

- Securities Transaction Tax (STT) on all trades

- GST on brokerage and other charges

- TDS implications if applicable

- Quarterly advance tax payments for substantial trading profits

Don’t forget about the new crypto taxation rules if your bot trades digital assets. The 30% flat tax rate and 1% TDS can significantly impact your returns.

Penalties for Non-Compliance with Indian Financial Laws

The penalties for regulatory violations are severe and can destroy your trading capital faster than any market loss. SEBI can impose fines ranging from ₹1 lakh to ₹25 crores depending on the violation’s severity. For unauthorized algorithmic trading, you’re looking at minimum penalties of ₹1 lakh per violation.

Exchange-level penalties add another layer of risk. Brokers can suspend your trading access, freeze your accounts, or terminate your relationship entirely. This leaves you unable to close positions or access your funds when you need them most.

Tax evasion penalties compound these risks. The Income Tax Department can impose penalties equal to 50-300% of the tax evaded. If they determine willful default, criminal prosecution becomes possible, leading to imprisonment and additional fines.

Your trading bot’s automated nature doesn’t excuse violations. Courts have held traders responsible for their systems’ actions, making ignorance an expensive defense.

Steps to Ensure Full Regulatory Adherence

Start by getting proper approvals before deploying any AI trading bots India. Submit your algorithm documentation to your broker and exchange for approval. This process takes time, so don’t rush into live trading without clearance.

Implement robust compliance monitoring in your trading system:

- Real-time position and loss limit monitoring

- Automated trade reporting and record-keeping

- Regular system audits and performance reviews

- Backup systems and disaster recovery procedures

Work with qualified professionals who understand automated trading legal issues. Your CA should specialize in trading taxation, and your legal advisor should know SEBI regulations inside out. These relationships cost money upfront but save you from expensive violations later.

Establish a compliance calendar tracking all reporting deadlines, tax payments, and regulatory submissions. Your bot might trade 24/7, but compliance requirements follow strict schedules.

Regular self-audits help catch problems before regulators do. Review your trading patterns, system logs, and compliance reports monthly. Document everything – from system changes to unusual trading patterns that might trigger regulatory scrutiny.

Read: AI’s Impact on Trading in India: Legal Reforms Explored

Technical Glitches and System Failures That Can Wipe Out Your Capital

Server Downtime During Critical Market Movements

You’re watching the markets like a hawk when suddenly your AI trading bot goes offline right during a major price swing. This nightmare scenario happens more often than you’d think, especially when using unreliable platforms or during high-traffic periods. Server downtime in algorithmic trading risks India can cost you thousands in missed opportunities or leave you trapped in losing positions.

Exchange servers crash during volatile sessions when trading volume spikes. Your bot might be programmed to exit a position at 3% profit, but if the server goes down and the stock jumps 8% before crashing back to breakeven, you’ve missed your planned exit entirely. Even worse, if you’re holding leveraged positions during downtime, you could face margin calls without any way to respond.

Major Indian brokers have experienced outages during crucial market events like budget announcements or RBI policy decisions. Your trading bot system failures during these moments can be financially devastating, especially if you’re running multiple strategies simultaneously.

Software Bugs That Execute Unintended Trades

Your AI trading bot contains thousands of lines of code, and even one misplaced decimal point can trigger catastrophic trades. Software bugs in automated trading systems have caused traders to lose their entire capital in minutes. You might think your bot is programmed to buy 100 shares, but a coding error could make it place an order for 10,000 shares instead.

Real-world examples include bots that:

- Execute trades in the wrong direction (buying instead of selling)

- Place orders with incorrect quantities or prices

- Get stuck in infinite loops, repeatedly placing the same trade

- Misinterpret market data and react to false signals

- Fail to implement stop-losses properly

These bugs often surface during live trading even after extensive backtesting because market conditions can trigger edge cases that weren’t considered during development. Your carefully planned risk management goes out the window when the bot starts behaving unpredictably.

Internet Connectivity Issues and Their Impact

Your internet connection is the lifeline between your trading bot and the markets. Even a brief disconnection can spell disaster for your automated strategies. When your connectivity drops, your bot can’t receive real-time market data, execute planned trades, or monitor existing positions.

Imagine your bot is programmed to sell when a stock hits your stop-loss level. If your internet goes down just as the stock starts plummeting, the bot can’t execute the sell order, and you’ll watch helplessly as your losses mount. By the time connectivity returns, the damage could be severe.

Indian internet infrastructure, while improving, still faces challenges:

- Power outages affecting broadband connections

- ISP maintenance windows during trading hours

- Monsoon-related connectivity disruptions

- Network congestion during peak usage times

Mobile data as a backup isn’t foolproof either. Network switching delays and data speed limitations can create execution delays that cost you money in fast-moving markets.

Building Redundancy Systems to Minimize Technical Risks

You need multiple backup systems to protect yourself from technical failures. Smart traders never rely on a single point of failure when running AI trading bots India strategies. Your redundancy plan should cover every possible failure point.

Set up these backup systems:

Multiple Internet Connections

- Primary broadband connection

- Secondary ISP as backup

- Mobile hotspot with different carrier

- Dedicated trading internet line if possible

Hardware Redundancy

- Backup computer or VPS (Virtual Private Server)

- Uninterruptible Power Supply (UPS) for power outages

- Battery backup for your modem and router

- Cloud-based bot hosting for 24/7 operation

Account Diversification

- Multiple brokerage accounts to spread risk

- Different trading platforms for various strategies

- Separate emergency accounts for manual intervention

Real-time Monitoring Systems

- SMS alerts for bot status changes

- Email notifications for trade executions

- Third-party monitoring services that track your bot’s health

- Mobile apps that let you intervene manually when needed

Choosing Reliable AI Trading Platforms with Proven Uptime

Your choice of trading platform can make or break your automated trading success. Don’t get lured by fancy marketing promises – focus on platforms with solid technical infrastructure and proven track records during market stress.

Research these key factors before committing:

| Platform Feature | What to Look For | Red Flags |

|---|---|---|

| Uptime History | 99.9%+ availability during trading hours | Frequent outages during volatile markets |

| Server Location | Indian servers for low latency | Overseas servers only |

| API Reliability | Stable API with proper documentation | Frequent API changes or downtime |

| Support Quality | 24/7 technical support during market hours | Email-only support with slow response |

Look for platforms that publish their uptime statistics and have transparent communication about technical issues. Check trading forums and communities to see how other algo traders rate different platforms’ reliability.

Test the platform’s performance during high-volatility periods before deploying significant capital. Many platforms work fine during calm markets but struggle when trading volumes spike. Your AI trading bot’s success depends heavily on the underlying platform’s ability to handle your orders reliably and quickly.

Consider platforms that offer guaranteed execution speeds and have direct market access rather than routing through multiple intermediaries. The extra cost is usually worth it when you’re running time-sensitive automated strategies.

The “Black Box” Problem

When you deploy an AI trading bot, you’re essentially handing over your money to a system that makes decisions you can’t understand. Think of it like getting into a taxi where the driver won’t tell you which route they’re taking or why they’re making specific turns. Your black box trading algorithms operate with complex mathematical models that even their creators sometimes struggle to explain.

You see numbers going up and down on your screen, but you have no clue whether the bot is buying stocks because it detected a pattern, reacted to news sentiment, or simply hit a random trigger. This lack of transparency becomes dangerous when your bot starts making trades that seem illogical or when it suddenly shifts strategies without warning.

Over-Optimization: When Perfect Backtesting Meets Harsh Reality

Your AI trading bots India might show stunning performance during backtesting, but here’s the catch: they’re trained on historical data that already happened. It’s like studying for an exam when you already know all the questions and answers.

This over-optimization trading bots problem means your bot becomes too specialized for past market conditions. When real market dynamics shift, your seemingly perfect algorithm crumbles. You’ll watch your bot make confident trades based on patterns that worked beautifully in 2020 but fail miserably in today’s market environment.

Consider this comparison of backtesting vs. live performance:

| Metric | Backtesting Results | Live Trading Reality |

|---|---|---|

| Win Rate | 85% | 45% |

| Monthly Returns | 15% | -8% |

| Maximum Drawdown | 5% | 35% |

| Trade Frequency | Optimal | Erratic |

No “Crash” Prediction Capability

Your AI trading bot cannot predict black swan events like the 2008 financial crisis, COVID-19 market crash, or sudden geopolitical tensions. Algorithmic trading risks India become amplified because these systems rely on historical patterns and technical indicators that become useless during unprecedented market shocks.

When markets crash, your bot doesn’t understand fear, panic, or irrational human behavior. It keeps following its programmed logic while real traders are running for the exits. You’ll find your positions getting deeper underwater as the bot continues buying into a falling market, thinking it’s found a “discount.”

The ChatGPT Trading Hype Trap

You might be tempted to use ChatGPT or similar language models for trading decisions, but this creates serious AI trading bot dangers. ChatGPT is designed to generate human-like text, not analyze financial markets. It can confidently recommend buying a stock while providing completely wrong reasoning.

These language models don’t have real-time market data, can’t process complex financial relationships, and often hallucinate facts about companies or market conditions. Using ChatGPT for trading is like asking your English teacher to perform brain surgery – they might sound confident, but they lack the specialized knowledge needed.

Hidden Costs and Overwhelming Complexity

Free AI trading bots India often come with surprise fees that eat into your profits. You’ll discover charges for:

- Real-time data feeds

- Premium algorithms

- Higher-frequency trading

- Customer support

- Platform upgrades

Meanwhile, sophisticated bots require technical expertise you might not possess. You’ll need to understand programming, market microstructure, risk management, and regulatory compliance. The learning curve becomes so steep that you’ll spend more time figuring out the bot than actually making profitable trades.

Your automated trading legal issues multiply when you can’t properly configure or monitor these complex systems, potentially violating regulations you didn’t even know existed.

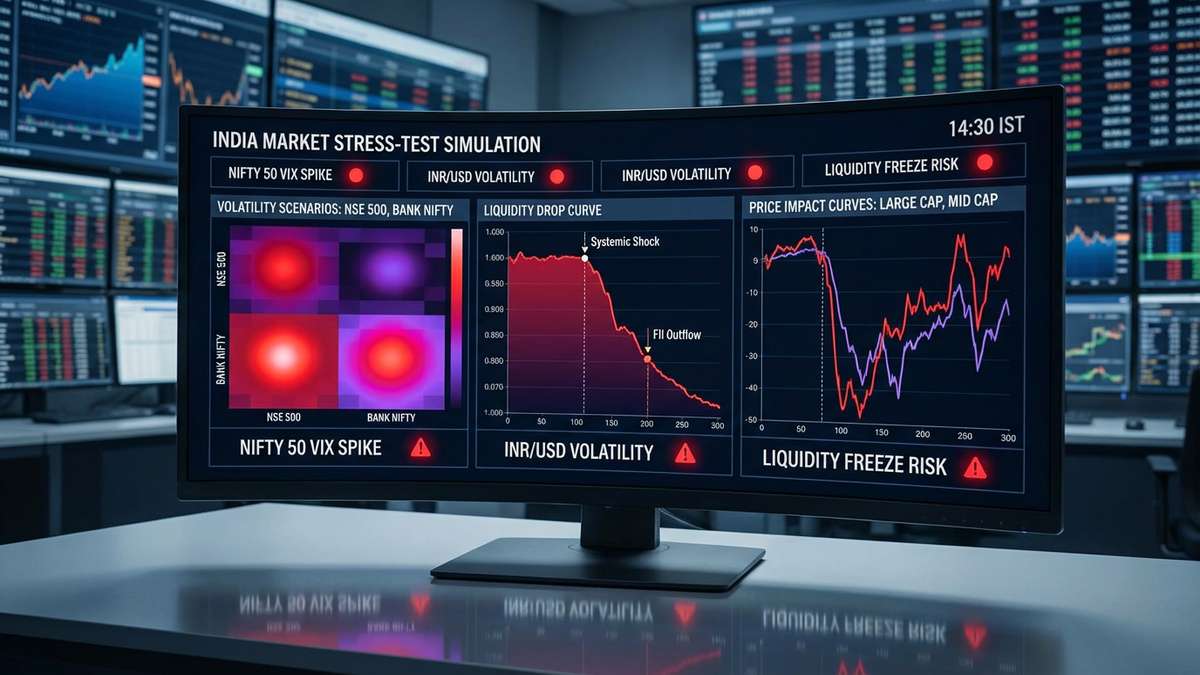

Market Volatility Amplification Leading to Massive Losses

How AI Bots Can Magnify Market Crashes

Your AI trading bot doesn’t just participate in market downturns—it can make them dramatically worse. When markets start falling, these algorithms often react identically, creating a dangerous snowball effect. Picture this: your bot detects a 5% drop and immediately sells to cut losses. Meanwhile, thousands of other AI trading bots India are programmed with similar logic, triggering simultaneous sell orders that push prices down even further.

This phenomenon becomes particularly dangerous in India’s markets, where liquidity can dry up quickly during volatile periods. Your bot’s attempt to protect your capital actually contributes to the very crash it’s trying to escape from. The speed at which these algorithmic trading risks India materialize is breathtaking—what might take human traders hours to process happens in milliseconds with bots.

Flash Crash Scenarios and Automated Selling

Flash crashes represent your worst nightmare as an AI trading bot user. These sudden, severe price drops happen when automated systems trigger cascading sell orders faster than markets can absorb them. Your bot, designed to react instantly to price movements, becomes part of a feedback loop that can destroy your portfolio in minutes.

During India’s trading hours, when global markets overlap, your bot might interpret normal price fluctuations as signals to execute massive trades. The 2010 Flash Crash in US markets saw prices plummet 9% in minutes before recovering—but your bot wouldn’t wait for the recovery. It would have sold at the bottom, locking in catastrophic losses.

The real danger lies in how these automated trading legal issues compound. Your bot can’t distinguish between temporary technical glitches and genuine market sentiment, leading to panic selling when patience would have been profitable.

Lack of Human Judgment During Extreme Market Conditions

Your AI trading bot operates in a world of pure data, completely blind to context that any human trader would immediately recognize. When geopolitical tensions spike, natural disasters hit, or unexpected policy announcements rock markets, your bot continues executing its programmed strategies without understanding the bigger picture.

Human traders pause during uncertainty. They read news, assess situations, and make judgment calls. Your bot? It sees patterns in price data and acts accordingly, even when those patterns are meaningless in the current context. This limitation becomes especially costly during trading bot system failures when markets behave unlike anything in your bot’s training data.

You’ve probably experienced this yourself—watching your bot make seemingly irrational trades during major news events while you helplessly realize it’s following historical patterns that no longer apply to the current situation.

Implementing Stop-Loss Mechanisms and Position Sizing

Your defense against these AI trading bot dangers starts with proper risk management programming. Smart stop-loss mechanisms aren’t just about setting percentage thresholds—they need to account for market volatility, time of day, and recent price behavior. A 2% stop-loss that works during calm periods might trigger unnecessarily during normal market fluctuations.

Position sizing becomes your safety net. Never let your bot risk more than 1-2% of your total capital on any single trade, regardless of how confident its algorithms seem. This rule protects you when multiple positions move against you simultaneously during market stress.

Consider implementing these protective measures:

- Dynamic stop-losses that adjust based on recent volatility

- Maximum daily loss limits that shut down trading after predetermined losses

- Correlation filters that prevent your bot from opening similar positions across related assets

- Circuit breakers that pause trading during unusual market conditions

Your bot should also incorporate position sizing based on volatility—smaller positions during turbulent periods and larger ones during stable market conditions. This approach helps you survive the inevitable periods when even the best algorithms struggle with unprecedented market behavior.

Security Breaches and Financial Data Theft Risks

Vulnerability to Hacking and Unauthorized Access

Your trading bot operates in a digital environment where cybercriminals constantly look for weak spots. When you connect your bot to trading platforms, exchanges, or cloud services, you’re creating multiple entry points that hackers can exploit. These security vulnerabilities can expose your sensitive financial information, trading strategies, and account credentials.

Hackers often target trading bots because they know these systems handle significant amounts of money and operate with minimal human oversight. Your bot might be running 24/7, making trades without your constant supervision, which means a security breach could go unnoticed for hours or even days. During this time, criminals can drain your accounts, manipulate your trading positions, or steal valuable market data.

The risks become even higher if you’re using AI trading bots India-based services that may not have robust security measures in place. Many automated trading platforms prioritize functionality over security, leaving your financial data exposed to potential threats.

API Key Theft and Account Takeovers

Your API keys are essentially the digital keys to your trading kingdom. These credentials allow your bot to access your exchange accounts, execute trades, and manage your funds. If someone steals your API keys, they gain complete control over your trading activities without needing your password or two-factor authentication.

API key theft happens more often than you might think. Cybercriminals use various methods to steal these credentials:

- Phishing attacks that trick you into entering your API keys on fake websites

- Malware that scans your computer for stored credentials

- Data breaches at third-party services where you’ve shared your keys

- Social engineering attacks targeting bot developers or platform employees

Once thieves have your API keys, they can execute unauthorized trades, transfer your funds to their accounts, or manipulate your bot’s behavior to benefit their own trading positions. The scariest part? Many exchanges don’t have adequate monitoring systems to detect suspicious API usage, so you might not discover the theft until significant damage is done.

Third-Party Platform Security Weaknesses

Most trading bots rely on third-party platforms, cloud services, and external APIs to function properly. Each of these connections represents a potential security weakness that could compromise your entire trading operation. You’re essentially trusting multiple companies with your financial security, and you have no control over their security practices.

Third-party platforms face constant security challenges:

| Risk Factor | Potential Impact | Your Exposure Level |

|---|---|---|

| Data breaches at cloud providers | Complete strategy exposure | High |

| Exchange security failures | Account compromise | Critical |

| Bot platform vulnerabilities | Unauthorized access | Medium to High |

| API service disruptions | Trading interruptions | Medium |

When you use AI trading bot services, you’re often sharing your trading strategies, account information, and market analysis with companies that might not have enterprise-level security measures. Smaller platforms especially struggle with security because they lack the resources to implement comprehensive protection systems.

Best Practices for Securing Your Trading Bot Setup

Protecting your automated trading setup requires a multi-layered approach that addresses each potential vulnerability. Start by implementing these essential security measures:

API Key Management:

- Create separate API keys for each bot with minimal required permissions

- Never grant withdrawal permissions unless absolutely necessary

- Regularly rotate your API keys, especially after any security concerns

- Store keys in encrypted password managers, never in plain text files

- Monitor your API usage logs for unusual activity

Platform Security:

- Choose established trading platforms with strong security track records

- Enable two-factor authentication on all your trading accounts

- Use dedicated email addresses for trading-related accounts

- Set up account monitoring alerts for all trading activities

Technical Safeguards:

- Run your bots on dedicated, isolated systems when possible

- Keep all software updated with the latest security patches

- Use VPN connections when accessing your trading accounts remotely

- Implement IP whitelisting on exchanges that support this feature

Operational Security:

- Limit the amount of capital your bot can access at any given time

- Set up automatic position limits and daily loss thresholds

- Regularly backup your bot configurations and trading data

- Create detailed logs of all bot activities for security auditing

Your security is only as strong as your weakest link. Even if you follow all these practices, you’re still vulnerable to risks beyond your control, like major exchange hacks or platform security failures. That’s why you should never invest more money in automated trading than you can afford to lose completely.

Over-Optimization and Curve Fitting That Destroys Real Performance

The Danger of Backtesting on Limited Historical Data

Your biggest mistake when evaluating AI trading bots India options is trusting backtesting results based on narrow time periods. Most bot developers showcase impressive returns using just 2-3 years of data, conveniently avoiding market crashes, bear markets, or unusual volatility periods. You’re essentially seeing a highlight reel, not the full movie.

When you back test on limited data, your algorithm learns patterns that might be coincidences rather than genuine market behaviors. Think of it like studying for an exam using only last year’s questions – you’ll ace that specific test but fail when faced with new scenarios. Your trading bot becomes overly specialized to specific market conditions that may never repeat.

Indian markets have unique characteristics – monsoon impacts, policy changes, festival seasons, and global economic shifts. If your bot’s training data doesn’t include events like demonetization, COVID-19 market crashes, or election volatility, you’re setting yourself up for disaster. The algorithm will confidently make trades based on patterns that simply don’t apply to current conditions.

How Perfect Past Performance Can Mislead Future Results

Perfect backtesting results should actually worry you, not excite you. When you see a trading bot claiming 95%+ accuracy or massive returns with minimal drawdowns, you’re looking at over-optimization trading bots that have been fine-tuned to exploit historical data quirks.

Your bot might show incredible performance because it “knows” that on March 15, 2020, markets crashed, so it goes short the day before. But this isn’t intelligence – it’s curve fitting. The algorithm has memorized specific events rather than learning genuine trading principles. When similar but not identical situations arise, your bot will fail spectacularly.

Real market trading involves uncertainty, losses, and periods of poor performance. If your backtesting doesn’t show drawdown periods, losing streaks, or volatility, the results are unrealistic. You need to see how the bot performs during different market phases:

- Bull markets with steady growth

- Bear markets with declining trends

- Sideways markets with range-bound trading

- High volatility periods with rapid price swings

- Low liquidity conditions during market holidays

Market Condition Changes That Render Strategies Obsolete

Markets evolve constantly, making yesterday’s winning strategies today’s losers. Your AI trading bot might excel during trending markets but crash during sideways movement, or vice versa. What worked during low interest rate environments might fail when rates rise.

Indian markets have transformed dramatically over the past decade. Algorithm trading has increased, retail participation has grown, and global correlations have strengthened. Strategies that worked when algorithmic trading was less common might now be arbitraged away by thousands of other bots running similar logic.

You also face regime changes – periods when market behavior fundamentally shifts. The pre-2008 market behaved differently than post-crisis markets. Similarly, post-pandemic trading shows new patterns. Your bot trained on old data won’t recognize these shifts and will keep applying outdated logic to new situations.

Currency fluctuations, regulatory changes, and global economic shifts create additional complications. A strategy optimized for stable rupee conditions might fail during currency volatility. Changes in margin requirements, circuit breaker rules, or trading hours can render your bot’s assumptions invalid overnight.

Strategies for Forward Testing and Strategy Validation

Before risking real money, run your bot through forward testing – also called paper trading or out-of-sample testing. This means testing your strategy on completely new data that wasn’t used during development. Reserve at least 20-30% of your historical data for this validation phase.

Use walk-forward analysis where you repeatedly test your strategy on rolling time periods. Train your bot on one year of data, test it on the next three months, then advance the window and repeat. This simulates how your bot would actually perform as new market data becomes available.

Implement multiple validation techniques:

| Validation Method | Purpose | Time Required |

|---|---|---|

| Cross-validation | Test stability across different data splits | 1-2 weeks |

| Monte Carlo simulation | Stress test under random scenarios | 3-5 days |

| Live paper trading | Real-time testing without capital risk | 1-3 months |

| Small capital deployment | Limited risk live testing | 2-4 months |

Monitor key performance metrics beyond just returns. Track maximum drawdown, win rate, average trade duration, and performance during different market conditions. Your bot should demonstrate consistent behavior, not wild swings between periods.

Maintaining Realistic Expectations About AI Trading Returns

Your AI trading bot won’t make you rich overnight, despite what social media advertisements claim. Realistic annual returns for algorithmic trading range from 8-15% for conservative strategies, with higher returns requiring proportionally higher risks and more sophisticated approaches.

Professional trading firms with unlimited resources, advanced technology, and expert teams typically target 15-25% annual returns. If you’re expecting 50-100% returns from a retail AI trading bot, you’re setting yourself up for disappointment and likely falling victim to over-optimization or outright scams.

Remember that every trading strategy goes through losing periods. Even successful bots experience drawdowns of 10-20% during difficult market conditions. You need sufficient capital to survive these periods without being forced to shut down your bot at the worst possible time.

Factor in all costs when calculating realistic returns. Transaction costs, software fees, data subscriptions, and infrastructure expenses can easily consume 2-4% of your annual returns. Your gross returns might look impressive, but net returns tell the real story of your bot’s profitability.

Using AI trading bots in India comes with serious risks that you need to understand before diving in. Regulatory violations can land you in legal trouble, while technical failures can wipe out your entire capital in minutes. These bots can also amplify market volatility, making your losses much worse than they need to be. On top of that, security breaches can expose your financial data, and over-optimized bots often fail spectacularly in real trading conditions because they’re too focused on past performance.

The biggest problem is that these bots operate like black boxes – you have no clue why they’re making specific trades. They can’t predict market crashes or sudden news events, and using general AI tools like ChatGPT for trading advice is downright dangerous. Remember, even “free” bots usually come with hidden costs, and the truly effective ones are complex and expensive. Your best bet is to start small, understand the technology you’re using, and never risk money you can’t afford to lose. Keep learning about the markets yourself – no bot should replace your own trading knowledge and judgment.

Read: AI Trading Checklist India: Upgrade Your Strategy in Minutes!

Disclaimer: This blog post is for informational purposes only and does not constitute financial, legal, or investment advice. Readers should consult qualified professionals, such as financial advisors or legal experts familiar with SEBI regulations, before using AI trading bots or implementing any strategies discussed. Trading involves significant risks, including potential loss of capital, and the information is based on sources believed reliable as of December 2025, but users must verify facts independently and assume responsibility for their decisions.