Filing Income Tax Returns (ITR) is no longer just about entering your Form 16 or bank statements and hitting submit. In 2025, the Income Tax Department expects you to cross-check your income and financial data with two powerful tools: AIS (Annual Information Statement) and TIS (Taxpayer Information Summary). Skipping this crucial step might seem harmless — but it can cost you heavily.

From delayed refunds to sudden income tax notices, ignoring AIS and TIS for ITR filing can turn into a costly mistake. If you’re relying solely on documents you have in hand, you may miss income that’s already been reported about you — even if you didn’t receive it yet.

In this blog, we’ll break down what AIS and TIS really are, why they matter more than ever in 2025, and how skipping them can land you in trouble — even if your income is entirely legitimate.

What Are AIS and TIS? (And Why Both Exist)

Before we talk about why you should never skip them, let’s understand what AIS and TIS actually are.

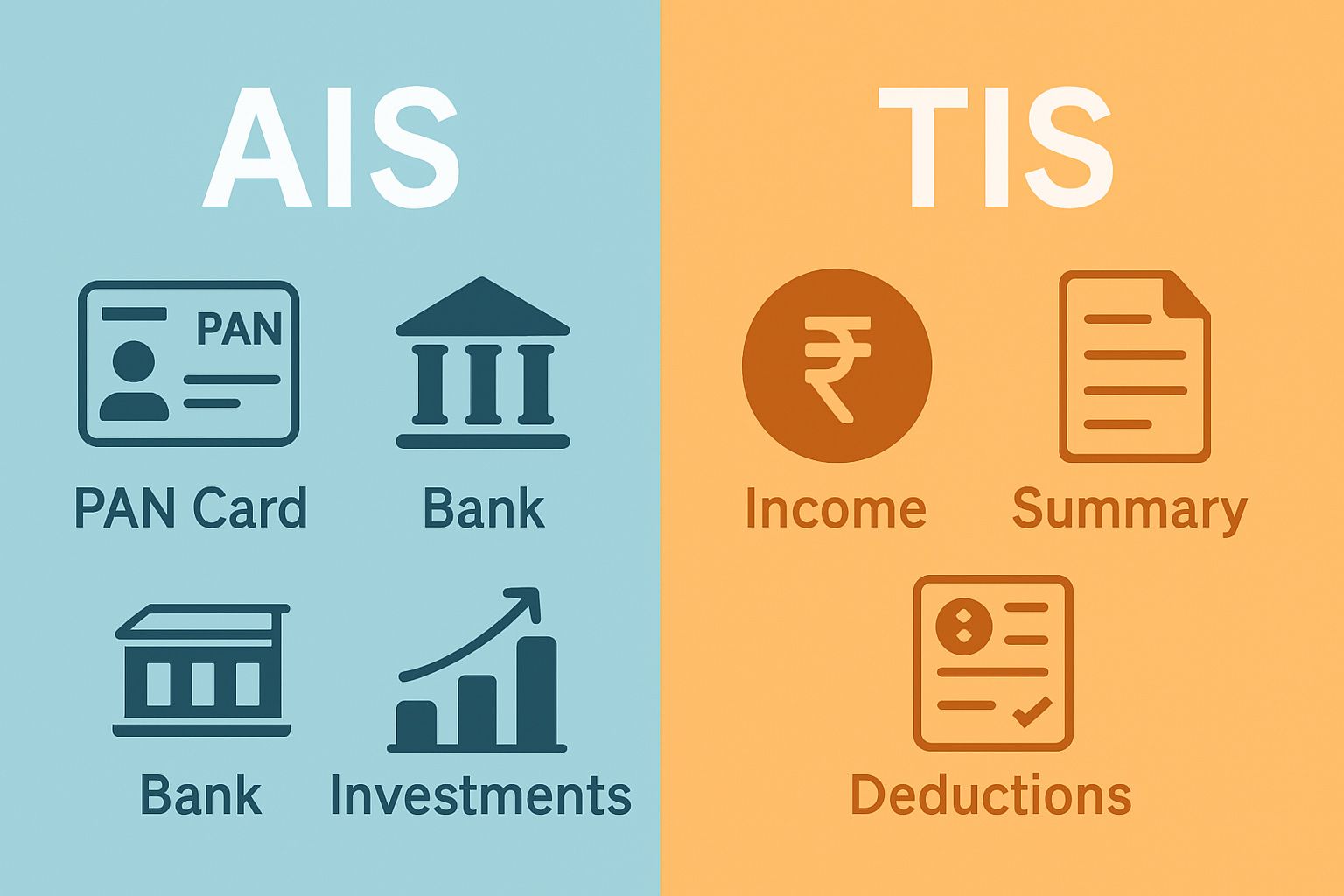

What is AIS (Annual Information Statement)?

AIS is a detailed statement that collects all financial transactions reported about you to the Income Tax Department from multiple sources.

It includes:

- Salary income

- Interest from savings and fixed deposits

- Mutual fund purchases/redemptions

- Stock trades and capital gains

- Dividend income

- High-value credit card spends

- Foreign remittances, and more

Where does AIS get this data from?

Various reporting entities like banks, employers, mutual fund houses, brokers, and even the EPFO submit your financial data under the Statement of Financial Transactions (SFT) framework. AIS consolidates all of this.

Purpose: AIS is not just for your reference. The IT department uses this to verify your ITR entries, and in many cases, to pre-fill certain sections.

What is TIS (Taxpayer Information Summary)?

TIS is a condensed, categorized summary of the information in AIS. It separates income into:

- Derived income (as calculated by the system)

- Declared income (by taxpayer)

- Accepted value (used for pre-filled ITR)

It’s like a ready-made report card that shows how much the system thinks you earned across categories — and flags mismatches automatically.

AIS vs TIS: What’s the Difference?

| Feature | AIS | TIS |

|---|---|---|

| Detail Level | High (transaction-wise) | Summary (category-wise) |

| Format | PDF, JSON, HTML | |

| Purpose | Transparency and verification | Used for prefilled ITR |

| Editable? | You can give feedback | No direct editing |

| Who uses it? | Taxpayer & ITD | Mainly ITD for auto-filled returns |

Think of AIS as the source document, and TIS as the executive summary.

Why AIS and TIS for ITR Filing Matter in 2025

Gone are the days when filing ITR was a manual task based only on what you declare. In 2025, the system cross-checks everything you declare against what it already knows via AIS and TIS.

Here’s why it matters:

AIS and TIS Are Now the Primary Data Points

- Prefilled ITRs now source values from TIS.

- Your income breakup (especially interest/dividends/capital gains) is calculated from AIS, not just your CA’s Excel sheet.

Refunds and Mismatches Are Based on AIS

- Even a ₹1 difference between your reported income and AIS data can delay refunds.

- You may get a Section 143(1) intimation correcting your ITR automatically, without asking you.

Triggers for Notices in 2025

The IT department can auto-trigger notices under:

- Section 139(9) – Defective return if crucial data is missing

- Section 148 – If income is under-reported compared to AIS

Real Examples from 2024-25 Filings

- A Salaried employee forgot ₹8,000 FD interest. Refund delayed for 6 months.

- A Crypto trader reported ₹2 lakh profit; AIS showed ₹4.6 lakh from exchanges. Notice issued under Section 148A.

In 2025, the Income Tax Department is watching not just what you file, but also what others have filed about you. That’s what makes AIS and TIS for ITR filing non-negotiable.

What Happens If You Skip AIS and TIS for ITR Filing?

Filing your Income Tax Return (ITR) without checking AIS and TIS is like appearing for an exam without reading the syllabus — it might cost you more than just a few marks.

Here’s what skipping AIS and TIS for ITR filing can lead to:

1. Mismatch Errors

Your ITR may mismatch with the income data available to the Income Tax Department (ITD). For example:

- You forgot to include a bank FD interest

- Missed reporting stock sale

- Ignored foreign remittances

If these are present in AIS but not in your ITR, you’re automatically inviting scrutiny.

2. Refund Delays

Claimed a TDS refund? If your AIS or TIS shows incorrect or missing details — or worse, contradicts your ITR — your refund may get delayed or even rejected.

3. Tax Notices or Intimations

While a single mismatch may not always trigger an IT notice, repeated inconsistencies or large-value unreported items often do. The ITD now uses AI-based systems to cross-check AIS/TIS data with your filed return.

4. Penalties & Interest

If skipping AIS and TIS for ITR filing leads to underreporting of income, you may be charged:

- Additional tax

- 50% to 200% penalty

- 1% interest per month on shortfall

Read : Penalties for Filing Wrong ITR

Top Mistakes Taxpayers Make with AIS and TIS

Even those who do check their AIS and TIS reports often fall into avoidable traps. Here are some common mistakes:

Mistake 1: Checking Only TIS Summary

TIS looks simple, but it’s just a summary. Many taxpayers rely solely on TIS, ignoring the transaction-level details in AIS. Result? Missed incomes or incorrect assumptions.

Mistake 2: Not Responding to Errors in AIS

Found an error in AIS? If you don’t submit feedback, the ITD assumes the data is correct. Many people skip this step and face consequences later during scrutiny.

Mistake 3: Assuming AIS is 100% Accurate

AIS pulls data from banks, employers, mutual funds, etc. But sometimes, entries can be duplicated, missing, or incorrectly tagged (e.g., dividend income shown twice). Blindly copying values without reviewing can lead to flawed ITRs.

Mistake 4: Missing New Data Uploads

AIS data is updated periodically. If you download your report too early in July, you may miss updates added later. Always check the last updated date before relying on the data.

How to Access AIS and TIS Correctly (Step-by-Step)

Here’s a step-by-step guide to safely access and download your AIS and TIS reports from the official Income Tax portal:

Step 1: Visit the Income Tax e-Filing Portal

Go to https://www.incometax.gov.in

Step 2: Log In Using PAN Credentials

- Use your PAN, Aadhaar, or other login methods.

- Enter OTP and access the dashboard.

Step 3: Navigate to AIS Section

- Click “Services” > “Annual Information Statement (AIS)”

- You’ll be redirected to the AIS portal.

Step 4: Select the Financial Year

Choose the relevant year for which you are filing your ITR.

Step 5: Download Reports

- Download AIS as PDF or JSON

- Also, download the TIS (Taxpayer Information Summary)

- Optionally, view online with filters and feedback tools

Step 6: Cross-check with Your Income

Before filing, match:

- Interest income from all banks

- Dividend income

- Salary and EPF contributions

- Share transactions or MF redemptions

- Foreign income or remittances

How to Fix Errors in AIS Before Filing ITR

Even the Income Tax Department knows that AIS can have incorrect or duplicate entries. That’s why they allow you to raise objections directly through the portal.

| Step | Action |

|---|---|

| 1. | Go to incometax.gov.in, log in and open AIS section |

| 2. | Choose relevant Financial Year |

| 3. | In the AIS view, click the ⚠️ icon next to the incorrect entry |

| 4. | Choose from options like:

|

| 5. | Submit appropriate feedback with optional supporting documents |

Once submitted, your response is logged. The IT department will reprocess TIS based on your input, usually within a few days.

Always keep screenshots or PDFs of your submitted feedback for reference. If discrepancies remain unresolved and you file ITR without clarification, it may lead to future notices.

When Should You Raise a Red Flag?

You shouldn’t blindly trust AIS — but also don’t panic every time there’s a small mismatch.

Don’t File Your ITR If You Notice These Red Flag:

1. High-Value Transactions You Never Made

If AIS shows a ₹5 lakh FD interest or sale of shares you didn’t actually sell — that’s a serious red flag. Raise feedback immediately.

2. Duplicate Entries

Some dividends, interest, or stock trades might appear twice (once from company, once from broker). Ignoring this can inflate your total income.

3. Transactions Belonging to Someone Else

Sometimes, a bank or institution may wrongly report income under your PAN. If it doesn’t match your records, it might be another person’s transaction.

4. TDS Mismatch

If your Form 26AS and AIS show different TDS amounts — or your AIS shows TDS but no matching income — verify and raise objections.

AIS and TIS – Not Just for Salaried Taxpayers

Most salaried individuals now know about AIS and TIS for ITR filing. But many other groups wrongly assume it doesn’t apply to them.

| Taxpayer Type | Why AIS Matters |

|---|---|

| Freelancers / Consultants | Clients may deduct TDS and report it in AIS |

| Senior Citizens | Interest from FDs, SCSS, Post Office is reported |

| Investors / Traders | Stock sales, MF redemptions, dividends, etc., are logged in AIS |

| NRIs | AIS includes foreign remittances and property deals |

| Self-Employed | Business transactions via UPI or cards may get flagged |

So whether or not you earn a regular salary — AIS is watching you.

Be Smart — Don’t Skip AIS and TIS

Skipping AIS and TIS for ITR filing is no longer a small oversight — it’s a costly mistake that can lead to mismatches, delayed refunds, or even income tax notices.

By checking and reconciling AIS and TIS:

- You avoid errors

- You save time

- You reduce your audit risk

- And most importantly, you stay on the right side of the law

Bottom Line: Take 15 minutes to cross-check your AIS and TIS. It might save you months of stress later.

Read : शून्य टॅक्स असतानाही ITR फाइल करणं का महत्त्वाचं आहे?

Disclaimer : The content of this blog is intended for general informational purposes only and should not be construed as professional tax advice. While we strive to keep the information accurate and up to date, tax laws and processes are subject to change. Always consult a qualified tax advisor or financial consultant before making decisions related to your Income Tax Return (ITR), AIS (Annual Information Statement), or TIS (Taxpayer Information Summary). The author and publisher are not responsible for any loss or consequences arising from the use of this information.