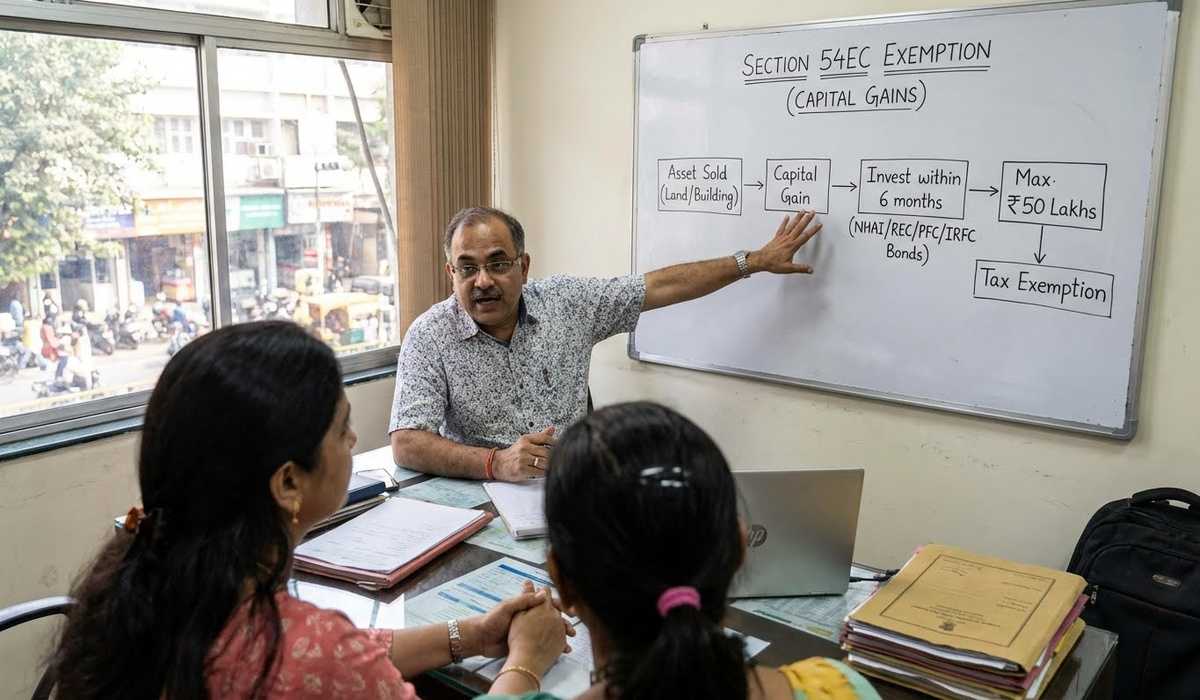

Selling your property in India can trigger hefty capital gains tax liability that significantly reduces your profits. If you’ve recently sold or are planning to sell immovable property like land or buildings, you can legally reduce your tax burden by investing in Capital Gain Bonds under Section 54EC of the Income Tax Act.

This tax-saving strategy is designed for property sellers, real estate investors, and anyone who has realized long-term capital gains from immovable property sales. By investing your capital gains in government-approved 54EC bonds within six months of the sale, you can claim complete tax exemption on the invested amount, potentially saving thousands in taxes.

In this guide, you’ll discover how Section 54EC tax exemption benefits work and what requirements you must meet to claim this valuable deduction. We’ll explore your options among government-approved capital gain bonds including NHAI bonds 54EC and REC bonds investment opportunities. You’ll also learn the step-by-step process for purchasing these bonds and see practical tax calculation methods to understand exactly how much you can save on your property sale tax benefits.

Understanding Section 54EC Tax Exemption Benefits

How Capital Gains Bonds Reduce Tax Liability on Property Sales

When you sell your immovable property and realize a profit, you become liable to pay capital gains tax on that profit. However, Section 54EC bonds offer you a strategic way to significantly reduce or completely eliminate this tax burden. By investing your capital gains in specified capital gain bonds India, you can claim an exemption under Section 54EC of the Income Tax Act.

The mechanism works by allowing you to reinvest the gains from your property sale into government-notified bonds, effectively deferring your tax liability. This means that instead of paying immediate capital gains tax to the government, you can redirect those funds into Section 54EC bonds, which not only saves you money but also provides you with a steady investment vehicle.

Your tax savings through this route can be substantial, especially if you’ve made significant profits from selling long-term immovable assets like land, buildings, or both. The beauty of this tax saving after property sale strategy lies in its simplicity – you’re essentially converting what would have been a tax payment into an investment that continues to generate returns for you over time.

These capital gains tax exemption bonds are specifically designed to encourage productive investment of capital gains while providing you with legitimate tax relief. The government benefits from having these funds channeled into infrastructure development through entities like NHAI and REC, while you benefit from the long term capital gains exemption and steady returns on your investment.

Eligibility Criteria for Individuals, HUFs, Companies and Other Entities

The 54EC tax exemption is remarkably inclusive in terms of who can benefit from it. As a taxpayer, you can claim this exemption regardless of whether you’re an individual investor, part of a Hindu Undivided Family (HUF), or represent a corporate entity.

If you’re an individual taxpayer who has sold immovable property and realized capital gains, you’re automatically eligible to invest in Section 54EC bonds and claim the corresponding tax exemption. This applies whether you’re a resident Indian or a non-resident (NRI), as long as you’ve generated capital gains from the sale of long-term immovable assets in India. For NRIs, while the exemption is available, repatriation of the sale proceeds or bond maturity amounts is subject to Foreign Exchange Management Act (FEMA) regulations, including an annual limit of USD 1 million per financial year for all outward remittances from the NRO account. You’ll need to submit Form 15CA (self-declaration) and Form 15CB (certificate from a chartered accountant) to your bank for compliance. Always consult a tax advisor for personalized guidance on repatriation rules.

Hindu Undivided Families (HUFs) also enjoy full eligibility for this benefit. If your HUF has sold property and generated capital gains, you can invest those gains in capital gain bonds India and claim the exemption just as individual taxpayers can.

Corporate entities, including companies, Limited Liability Partnerships (LLPs), and firms, are equally eligible for 54EC bonds eligibility criteria. This broad eligibility ensures that businesses that have sold immovable assets as part of their operations can also benefit from this tax-saving mechanism.

The eligibility extends to other entities as well, making this a universally accessible tax-saving tool for property sellers across different organizational structures. Whether you’re a sole proprietor, partnership firm, or any other recognized business entity, you can leverage NHAI bonds 54EC and similar instruments for tax optimization.

Maximum Investment Limit of Rs. 50 Lakhs Per Financial Year

Understanding the investment limits for Section 54EC bonds is crucial for your tax planning strategy. The government has set a maximum investment cap of Rs. 50 lakhs that applies across a specific timeframe, and you need to be aware of how this limit works to maximize your property sale tax benefits.

Your total investment in these bonds cannot exceed Rs. 50 lakhs during the current financial year combined with the subsequent financial year. This means you have a two-year window to make investments up to this cumulative limit, providing you with flexibility in timing your investments based on your capital gains realization.

For example, if you sell property in the current financial year and generate capital gains, you can invest up to Rs. 50 lakhs across both the current financial year and the following financial year. This could mean investing Rs. 30 lakhs in the current year and Rs. 20 lakhs in the next year, or any other combination that doesn’t exceed the total limit of Rs. 50 lakhs.

This investment limit applies to your total investment in all types of capital gains tax exemption bonds, including NHAI bonds 54EC, REC bonds investment, and any other government-notified bonds under this section. You cannot exceed Rs. 50 lakhs even if you’re investing across different bond issuers.

The limit is designed to balance the government’s revenue considerations with providing meaningful tax relief to property sellers. While Rs. 50 lakhs may seem restrictive for very high-value property transactions, it still represents substantial tax savings for most property sellers, making REC bonds investment and similar instruments valuable tools in your tax planning arsenal.

Essential Requirements for Claiming Section 54EC Exemption

Long-term capital asset criteria for land and buildings

When you’re planning to claim Section 54EC tax exemption, your sold property must meet specific criteria to qualify for this benefit. The asset you’re selling must be classified as a Long Term Capital Asset, which includes land, building, or both. This classification is crucial because it determines your eligibility for the entire tax exemption scheme.

The most critical requirement for your property to qualify as a long-term capital asset is the holding period. You must have owned the land or building for a minimum of 24 months prior to the sale. This 24-month period is calculated from the date of acquisition to the date of transfer. If you’ve held your property for less than this period, it becomes a short-term capital asset, and you cannot claim benefits under Section 54EC bonds.

Your property ownership timeline directly impacts your tax planning strategy. Whether you’ve inherited the property, purchased it, or received it through any other means, the 24-month holding requirement remains non-negotiable. This extended holding period ensures that only genuine long-term investments qualify for capital gains tax exemption bonds benefits.

Six-month investment deadline from property sale date

Once you’ve successfully sold your qualifying long-term capital asset, time becomes a critical factor in your tax planning. You have a strict six-month window to invest your capital gains in 54EC bonds to claim the tax exemption. This deadline is calculated from the actual date of transfer of your immovable property, not from the date of registration or any other associated dates.

The six-month investment deadline is absolute and non-extendable under any circumstances. If you miss this crucial timeline, you forfeit your opportunity to claim Section 54EC tax exemption benefits entirely. This means your entire capital gains from the property sale become fully taxable as long-term capital gains in the year of sale.

Your investment strategy should account for this tight timeframe. Consider identifying suitable capital gain bonds India options beforehand, complete your due diligence on available bonds, and have your investment process ready to execute promptly after your property sale. Popular options include NHAI bonds 54EC and REC bonds investment, which you can research in advance to make informed decisions within the stipulated period.

Five-year lock-in period restrictions and penalties

After you invest in 54EC bonds, you enter into a mandatory five-year lock-in period that begins from the date of acquisition of these bonds. During this period, you face several restrictions that significantly limit your financial flexibility with these investments.

Throughout the five-year lock-in period, you cannot transfer your bonds to any other person or entity. This restriction applies regardless of your financial circumstances or emergencies that may arise. Additionally, you cannot convert these bonds into any other form of investment or financial instrument during this period.

One of the most restrictive aspects of the lock-in period is the prohibition on using your 54EC bonds as collateral for loans or advances. This means you cannot leverage these investments to secure funding for other financial needs, even in urgent situations. Banks and financial institutions are aware of these restrictions and typically do not accept these bonds as security during the lock-in period.

The penalty for breaking the lock-in period is severe and immediate. If you convert your capital gain bonds into cash before the maturity period ends, the entire amount you invested becomes taxable as long-term capital gains in the year of conversion. This penalty effectively negates all the tax benefits you initially claimed under Section 54EC bonds eligibility criteria. The tax liability includes not only the principal tax amount but may also attract interest and penalties for the period during which the tax remained unpaid.

Your financial planning should carefully consider these restrictions before investing in property sale tax benefits through 54EC bonds, as the lock-in period significantly impacts your liquidity for five years.

Government-Approved Capital Gain Bonds Options

Rural Electrification Corporation Limited (REC) bonds

When you’re exploring Section 54EC bonds options for your capital gains tax exemption, REC bonds stand out as one of the most established government-approved investment vehicles. As a government-backed entity focused on financing power sector infrastructure projects across rural India, REC offers you a secure investment opportunity that qualifies for tax benefits under Section 54EC.

Your investment in REC bonds directly supports the nation’s rural electrification initiatives while providing you with the essential tax exemption on long term capital gains from your property sale. These bonds typically offer competitive interest rates and come with the full backing of the Government of India, ensuring your investment remains secure throughout the tenure.

National Highway Authority of India (NHAI) bonds

Moving to another crucial infrastructure sector, NHAI bonds present you with an excellent opportunity to channel your capital gains into India’s highway development projects. When you invest in NHAI bonds under the 54EC tax exemption scheme, you’re not only securing tax benefits but also contributing to the country’s transportation infrastructure growth.

Your NHAI bonds investment helps fund critical highway projects that connect different parts of India, making these bonds both socially impactful and financially beneficial for your tax planning needs. The interest rates offered by NHAI bonds are competitive within the Section 54EC bonds category, and the government backing ensures complete safety of your principal amount.

Power Finance Corporation Limited (PFC) bonds

As you consider your capital gain bonds India options, PFC bonds emerge as another government-approved choice for your 54EC tax exemption requirements. PFC specializes in financing power generation, transmission, and distribution projects across the country, making your investment directly contribute to India’s energy sector development.

Your investment in PFC bonds qualifies for the complete tax saving after property sale benefits under Section 54EC, while the interest earned provides you with a steady income stream. These bonds carry the government’s guarantee, ensuring that your investment remains protected while you enjoy the dual benefits of tax exemption and regular returns.

Indian Railway Finance Corporation Limited (IRFC) bonds

With the railway sector being a cornerstone of Indian infrastructure, IRFC bonds offer you another viable option for your property sale tax benefits strategy. When you invest in IRFC bonds, you’re supporting the modernization and expansion of India’s railway network while securing your capital gains tax exemption eligibility criteria compliance.

Your IRFC bonds investment helps fund various railway projects, from track modernization to rolling stock procurement, making these bonds an integral part of the nation’s transportation infrastructure development. The government backing ensures complete security of your investment, while the interest rates remain competitive with other 54EC bonds options available in the market.

Now that we have covered all four primary government-approved capital gain bonds options, you can make an informed decision based on your investment preferences and the specific infrastructure sector you wish to support through your tax-saving investment.

While REC, NHAI, PFC, and IRFC are the primary government-approved issuers for 54EC bonds as of January 2026, availability can fluctuate based on issuance windows and notifications from the Central Board of Direct Taxes (CBDT). For instance, NHAI has paused issuances in the past, but all four are currently active. Always check the latest status on the issuers’ official websites (e.g., recindia.nic.in, nhai.gov.in, pfcindia.com, irfc.nic.in) or through authorized banks before applying, as bonds may not be open for subscription year-round.

Tax Calculation Methods with Capital Gain Bonds Investment

Complete Tax Exemption Scenarios with Full Capital Gains Investment

When you invest the entire amount of your long-term capital gains from property sale into Section 54EC bonds, you can achieve complete tax exemption on your capital gains. This scenario represents the most advantageous tax-saving opportunity available under the Section 54EC provisions.

To qualify for complete tax exemption, you must invest your total long-term capital gains amount in capital gain bonds India within the stipulated timeframe of 6 months from the date of property transfer. However, it’s crucial to understand that this complete exemption is subject to the maximum investment limit of INR 50 lakh per financial year under Section 54EC bonds.

Here’s how the complete exemption works in practice:

When your capital gains are ≤ INR 50 lakh: You can invest the entire amount and reduce your taxable long-term capital gain to Nil

When your capital gains exceed INR 50 lakh: You can only invest up to INR 50 lakh, achieving partial exemption on the excess amount

The beauty of this complete tax exemption lies in its immediate impact on your tax liability. Once you make the qualifying investment in 54EC tax exemption bonds, your taxable long-term capital gain becomes zero for the invested amount, effectively eliminating the 20% tax burden (plus applicable cess and surcharge) that would otherwise apply to your property sale profits.

Partial Tax Exemption When Investment is Less Than Capital Gains

Now that we have covered complete exemption scenarios, let’s examine situations where you invest less than your total capital gains amount. In partial tax exemption cases, only the amount you actually invest in Section 54EC bonds receives tax exemption benefits, while the remaining capital gain remains fully taxable.

This partial exemption scenario typically occurs in two situations:

Scenario 1: Voluntary Partial Investment

You may choose to invest only a portion of your capital gains in 54EC bonds due to liquidity needs or investment diversification strategies. In such cases, you’ll receive proportional tax benefits based on your actual investment amount.

Scenario 2: Investment Exceeding the INR 50 Lakh Limit

When your long-term capital gains exceed INR 50 lakh, you’re restricted by the maximum annual investment limit under Section 54EC. The excess amount beyond INR 50 lakh remains taxable despite your intention to claim complete exemption.

The tax calculation for partial exemption follows this formula:

Exempt amount: Actual investment in capital gains tax exemption bonds

Taxable amount: Total capital gains minus invested amount

For example, if you have capital gains of INR 70 lakh and invest INR 40 lakh in NHAI bonds 54EC, only INR 40 lakh receives tax exemption. The remaining INR 30 lakh becomes taxable at applicable rates, resulting in significant tax liability that could have been avoided with optimal planning.

Tax Implications of Early Bond Redemption Before Maturity

With this in mind, next, we’ll examine the critical tax consequences of redeeming your Section 54EC bonds before their mandatory 5-year maturity period. Understanding these implications is essential for making informed decisions about your long term capital gains exemption strategy.

The tax implications of early redemption are particularly severe and can completely negate the tax benefits you initially claimed. When you convert your capital gain bonds into cash before completing the 5-year maturity period, the amount on which you previously claimed tax exemption becomes taxable as long-term capital gain in the year of conversion.

This means that the tax benefit you enjoyed earlier gets reversed, and you must pay the deferred tax liability along with applicable interest and penalties. The government treats early redemption as a breach of the Section 54EC conditions, effectively disqualifying your initial tax exemption claim.

Key aspects of early redemption tax implications include:

Immediate Tax Liability Creation

The moment you redeem your REC bonds investment or other 54EC bonds before maturity, you create a taxable event. The previously exempt amount gets added to your taxable income for that financial year.

Loss of Future Tax Benefits

Early redemption not only creates immediate tax liability but also permanently disqualifies you from claiming any future benefits on those specific bond investments.

Additional Compliance Requirements

You must report the early redemption in your income tax return for the year of conversion, calculating and paying the applicable long-term capital gains tax on the redeemed amount.

This punitive tax treatment ensures that investors maintain their property sale tax benefits investments for the complete 5-year period, aligning with the government’s long-term infrastructure financing objectives through these specialized bonds.

Step-by-Step Process for Purchasing 54EC Bonds

Downloading Application Forms from Bond Issuers

When you’re ready to invest in Section 54EC bonds for your capital gains tax exemption, your first step involves obtaining the correct application forms from authorized bond issuers. You’ll need to visit the official websites of government-approved bond issuers such as REC (Rural Electrification Corporation), PFC (Power Finance Corporation), or IRFC (Indian Railway Finance Corporation) to download their respective bond application forms.

These application forms are typically available in ZIP format on the issuers’ websites, which means you’ll need to unzip the downloaded files before you can access the actual forms. Once you’ve successfully downloaded and extracted the files, you should print the application form to proceed with the manual filling process. It’s crucial that you follow the specific instructions provided with each form, as different bond issuers may have varying requirements for form completion.

Pay careful attention to all the sections in the application form, ensuring you provide accurate information about your capital gains, property sale details, and investment amount. The precision with which you fill out these forms can significantly impact the processing time and approval of your 54EC bonds investment.

Payment Methods Through Demand Draft or Bank Transfer

Now that you have your application form ready, you’ll need to arrange for payment using one of the approved methods. The most traditional approach involves preparing a demand draft or account payee cheque for the investment amount. When opting for this method, you must ensure that the demand draft is drawn in favor of the specific bond issuer and includes all necessary enclosures as specified in the application instructions.

The demand draft method requires you to visit your bank, request the draft for the exact investment amount, and attach it securely to your completed application form. This payment method, while conventional, provides a clear paper trail for your Section 54EC bonds investment.

Alternatively, you can choose the more convenient electronic transfer method through NEFT (National Electronic Funds Transfer) or RTGS (Real Time Gross Settlement). For this option, you’ll need to transfer your investment amount directly into the respective collection account specified by the bond issuer. This modern payment approach offers faster processing and eliminates the need for physical demand drafts.

When using bank transfer methods, you must carefully note down the UTR (Unique Transaction Reference) number generated after the successful transfer. This UTR number serves as proof of payment and must be mentioned in your online application form or attached documentation. The UTR number is essential for the bond issuer to track and verify your payment, making it a critical component of your capital gains tax exemption investment process.

Submission Process at Designated Collecting Banks

With this in mind, next, you’ll need to submit your completed application and payment documentation at designated collecting banks. The government has authorized specific banks to handle Section 54EC bonds applications, ensuring a streamlined process for investors seeking capital gains tax exemption benefits.

Your designated collecting bank options include Axis Bank, Canara Bank, State Bank of India, HDFC Bank, ICICI Bank, IDBI Bank, IndusInd Bank, and Yes Bank. You can choose any of these banks based on your convenience and proximity, as all are equally authorized to process your 54EC bonds investment application.

When submitting your application, ensure you carry both the original filled application form and appropriate payment proof. If you’ve used the demand draft method, attach the original demand draft to your application. For bank transfer payments, include a printed copy of the transfer receipt along with the UTR number clearly mentioned on your application form.

The bank officials at these designated collecting banks are trained to handle Section 54EC bonds applications and can guide you through any last-minute clarifications. They will verify your documents, ensure completeness of your application, and provide you with an acknowledgment receipt for your submission.

This acknowledgment receipt is crucial for tracking your application status and serves as proof of your timely investment in capital gain bonds India. Keep this receipt safe, as you may need it for future correspondence regarding your 54EC tax exemption investment and for maintaining records for your tax filing purposes.

Investing in capital gain bonds under Section 54EC offers you a strategic way to minimize your tax liability when selling immovable property. By understanding the eligibility requirements, choosing from government-approved bonds like REC, NHAI, PFC, or IRFC, and completing your investment within the mandatory 6-month timeframe, you can effectively reduce or eliminate your long-term capital gains tax burden. Remember that your investment is capped at Rs. 50 lakhs and must be held for 5 years without transfer or conversion.

The step-by-step purchase process is straightforward, requiring you to download forms directly from bond issuers and submit them through designated collecting banks. While these bonds offer valuable tax savings, ensure you carefully plan your investment amount based on your actual capital gains to maximize the exemption benefit. Take action promptly after selling your property to meet the 6-month investment deadline and secure your tax-saving opportunity under Section 54EC.

Also Read: Wills vs Nominations: Who Truly Inherits Your Wealth?