Credit Card Closure Process in India: How to Close a Card Safely

I was recently looking through my own wallet—a graveyard of magnetic strips and NFC chips accumulated over 14 years of investing and spending. There was this one card, a relic from a time when I thought airline miles were the holy grail of finance, now sitting there collecting dust and charging me ₹2,500 + GST every year.

My instinct? Grab the scissors. It’s a visceral, satisfying feeling to cut that plastic in half.

But as an engineer who has spent years looking at the backend systems of financial institutions, and as an investor who treats his CIBIL score like a prized portfolio, I put the scissors down.

We need to talk about the mechanics of “breaking up” with a bank. It is not an art project; it is a formal financial procedure. If you treat it like the former, you might find yourself with a damaged credit history right when you’re applying for that home loan.

Let’s dissect the data, the regulations, and the math behind closing a credit card properly.

Why Annual Fees Still Apply After Credit Card Closure

There is a fundamental misconception among Indian consumers that the plastic card is the account. It isn’t. The card is merely a hardware token—a key to access a credit line that lives on a server.

When you cut the card, you are destroying the key, but the door remains wide open. And as long as that door is open, Annual Maintenance Charges (AMC) will accrue.

Here is the reality check: Closing a credit card is a “divorce” process. It requires paperwork (digital or otherwise) and mutual consent. If you ghost the bank, they don’t just go away. They report “non-payment of fees” to the credit bureaus.

I have seen CIBIL scores drop by 50-80 points simply because a user destroyed a card but ignored the ₹500 renewal fee statement that arrived two months later. In the world of algorithmic lending, that oversight categorizes you as a defaulter. We want to avoid that.

The Regulatory Shift: From Nightmare to 7-Day Guarantee

If you tried to close a card before 2022, you know the drill. It was a war of attrition. You would call customer care, get routed to a “retention specialist,” endure a 20-minute sales pitch, and often, the request would simply “disappear.”

However, the landscape shifted dramatically with the RBI Master Direction – Credit Card and Debit Card – Issuance and Conduct Directions, 2022.

As someone who analyzes policy impact, this was a watershed moment for consumer rights. The Reserve Bank of India introduced a hard-coded SLA (Service Level Agreement):

The 7-Day Rule

Banks must honor a closure request within seven working days, subject to payment of all dues.

The Penalty Protocol

If the bank fails, they are liable to pay a penalty of ₹500 per day of delay to the customer.

This shifted the power dynamic. The bank no longer holds the cards (pun intended). You do. But you have to know how to play the hand.

The “Should You Stay or Should You Go?” Debate

Before we execute the closure, we must run a cost-benefit analysis. In my MBA days, we called this rationalizing the asset base.

Financial gurus often scream “Don’t close old cards!” Is that valid? Yes, but with caveats. Here is the data-driven logic behind why you might want to keep a card:

1. The “Vintage” Factor (Credit Age)

Credit bureaus like TransUnion CIBIL look at the “Average Age of Accounts.” A card you have held for 8 years anchors your credit history. Closing it removes that long history from the algorithm, potentially shortening your average age and adding volatility to your score.

2. The Limit Buffer (Credit Utilization Ratio)

This is simple math.

- Scenario A: You have 2 cards. Card A (Limit ₹1L) and Card B (Limit ₹1L). Total Credit Limit = ₹2L. You spend ₹50,000. Your Utilization Ratio is 25% (Excellent).

- Scenario B: You close Card B. Total Limit drops to ₹1L. You still spend ₹50,000. Your Utilization Ratio hits 50% (High Risk).

The Verdict:

Only proceed with closure if:

- The Annual Fee outweighs the rewards you earn.

- The card encourages undisciplined spending.

- The Customer Service is non-existent.

The Loophole:

In my personal strategy, I rarely close old cards. Instead, I call the bank and ask to downgrade the premium card to a basic “Lifetime Free” (LTF) card. This keeps the credit history (“vintage”) alive and maintains the credit limit, but eliminates the annual cost.

The Drama: Common Traps and Bank Tactics

When you initiate a closure, you trigger a “Retention Workflow” at the bank.

The Retention Guilt Trip

You will receive calls offering fee waivers, 2,000 bonus reward points, or shopping vouchers. This isn’t charity; it’s customer acquisition cost management. It is cheaper to bribe you to stay than to find a new customer. If the offer makes mathematical sense (e.g., the waiver makes the card free), take it. If not, be firm.

Block vs. Close: The Terminology Trap

This is where many stumble. Use the words “Cancel” or “Close” explicitly in your communication.

- Blocking is a security measure for lost/stolen cards. The account remains active. Fees continue.

- Canceling/Closing is the termination of the credit facility.

The Score Drop Surprise

Do not panic if your score dips slightly (10-20 points) the month after closure. This is usually due to the mathematical adjustment in your utilization ratio I mentioned earlier. As long as you don’t max out your remaining cards, the score corrects itself quickly.

Read: Buy Now, Pay Later: BNPL Mistakes That Destroy Your Credit Score

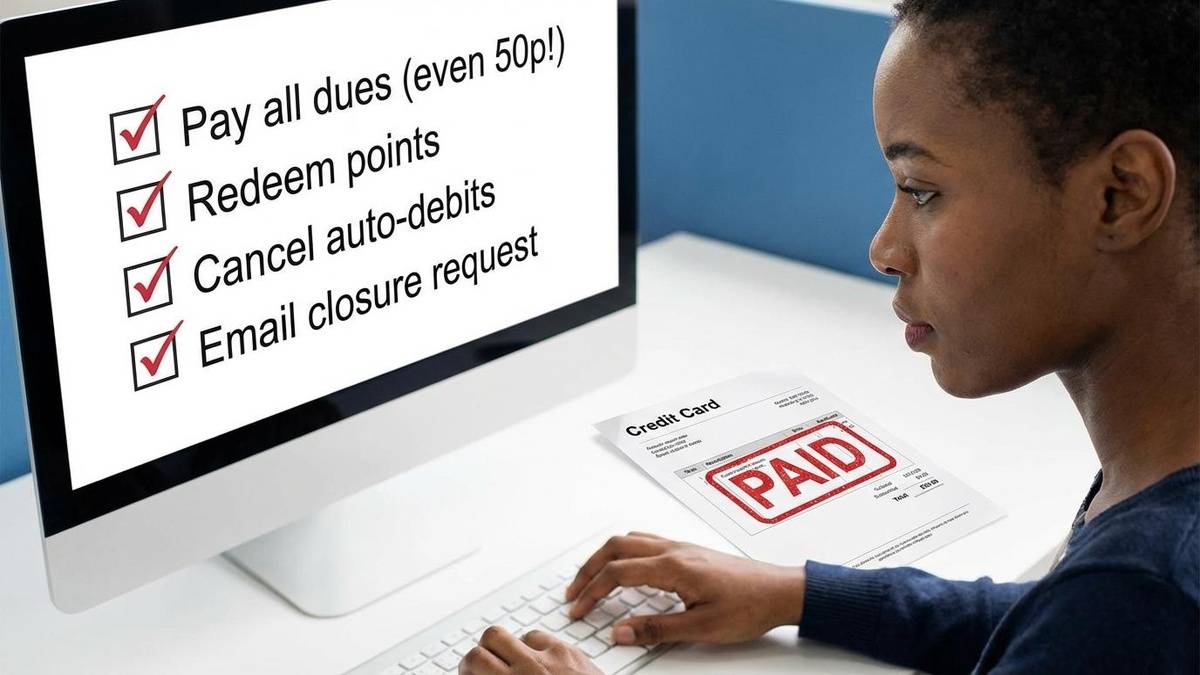

The How-To Guide: The Clean Break

If you have decided to proceed, execute this like a project manager. Do not leave loose ends’

The Zeroization (The Cleanup)

Pay off every single paisa. If your outstanding is ₹0.50, pay ₹1.00. Systems are binary. Crucial: Redeem your reward points. Once the closure request is logged, points usually evaporate instantly.

The Kill Switch

Cancel all Standing Instructions (SI) linked to the card (Netflix, Spotify, Utility Bills). If a recurring charge hits the card after you request closure, the request may be rejected.

The Paper Trail (Email or IVR)

While apps allow closure, I prefer email. Ask for a Service Request (SR) Number.

The NOC (The Shield)

This is the most important step. Once closed, demand a No Objection Certificate (NOC). The NOC is your legal proof that you owe nothing, protecting you from “Zombie Debt” glitches.

Crystal Ball: The Future of Credit Card Closures

Looking ahead to late 2026 and beyond, the friction of closing cards will likely disappear entirely due to two factors:

- The “Ghosting” Rule: The RBI has already mandated that if a card is inactive for more than a year, the bank must initiate the closure process after alerting the user. This prevents the accumulation of hidden fees on dormant accounts.

- Account Aggregators (AA): We are moving toward a centralized financial dashboard. Soon, you won’t need to log into the HDFC or SBI app separately. You will likely be able to revoke credit permissions from a central AA interface, making the “breakup” as easy as unsubscribing from a newsletter.

Conclusion

Closing a credit card feels liberating—it’s financial decluttering. But in finance, as in engineering, the method matters as much as the intent.

Don’t just cut the plastic. Clear the dues, secure the NOC, and protect your data history. You are not just closing an account; you are curating your financial reputation.

Action Item:

If you closed a card recently, log in to check your CIBIL report after 45 days. Ensure the account status explicitly says “CLOSED” and the “Date Closed” is accurate. If it says “Active,” you have some emails to write.

Credit Card Closure FAQs

Q1. Does closing a credit card reduce CIBIL score?

Yes, improper credit card closure can reduce your CIBIL score by 50–80 points if dues or fees remain unpaid.

Q2. Is NOC mandatory after closing a credit card?

Yes, NOC confirms zero dues and prevents incorrect reporting to credit bureaus.

Q3. How long does credit card closure take in India?

Typically 7–10 working days, but CIBIL updates may take 30–45 days.

Q4. Can annual fees apply after card closure request?

Yes, if the account is not officially closed in bank systems.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial or legal advice. Credit card policies, charges, and reporting practices may vary by bank. Readers should verify details with their card issuer and credit bureau before taking action. PaisaForever.com is not responsible for decisions based on this content.