Are you eager to invest in the world’s top markets—but feel lost in paperwork, puzzled by rules, or worried about taxes and hidden fees? You’re not alone. Many Indians want to diversify beyond Indian stocks and mutual funds, yet the path to global investing can seem confusing and expensive.

Enter GIFT City: India’s very own international financial hub that quietly opens the doors to global markets—with fewer hurdles and smarter cost savings than you might expect. If you’ve wondered “Should I try GIFT City or stick to old-school routes?”—this guide is your one-stop resource for answers, clarity, and confidence.

GIFT City—India’s Bridge to the World’s Markets

What is GIFT City?

GIFT City (Gujarat International Finance Tec-City) is India’s ambitious answer to Singapore, Dubai, and London—a state-of-the-art financial center near Ahmedabad that acts as a global gateway for investments. The Indian government set up GIFT City to compete internationally and bring world-class opportunities to Indian investors, right from home.

Why Should Indians Care About GIFT City?

- It offers a streamlined way to invest in both Indian and global markets from a single account.

- Features regulatory and tax conveniences designed to make cross-border investing smoother.

- Welcomes a broad range of investors—including NRIs, resident Indians, and even institutions.

How GIFT City is Different

Think of GIFT City as operating under a “best of both worlds” rulebook:

- For currency and foreign exchange, it’s treated as an “overseas” center.

- For tax purposes, it’s recognized as part of India.

This unique setup offers something called “regulatory arbitrage”—in simple terms, it lets you bypass some of the old headaches (like overseas paperwork and double taxation) that hold back most Indian investors.

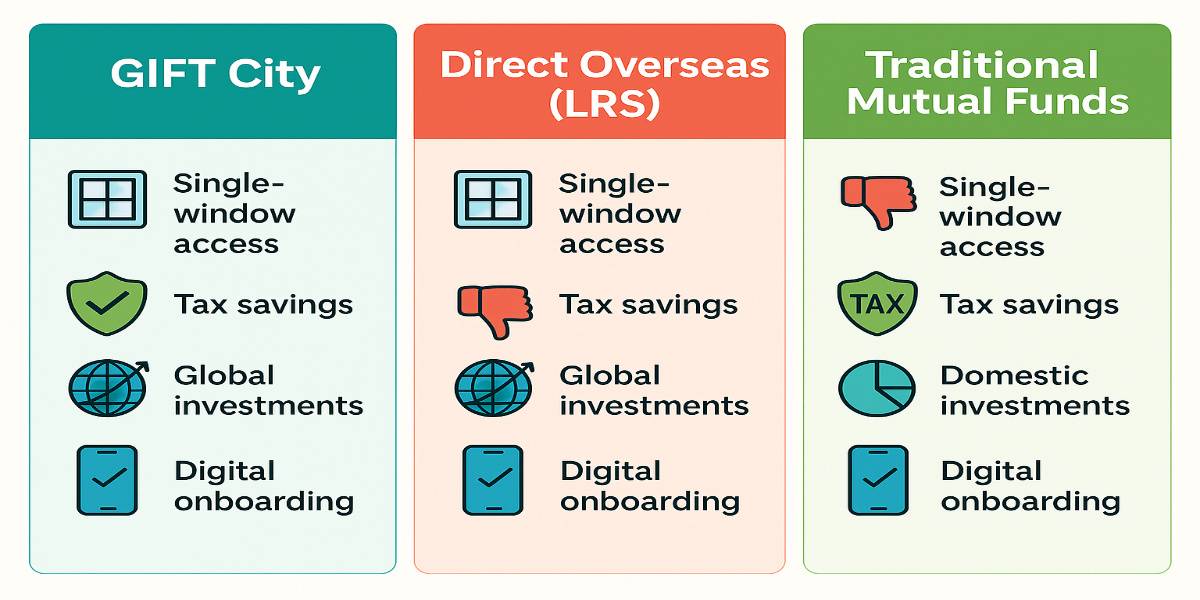

GIFT City vs. Traditional Investing Routes—At a Glance

Here’s how GIFT City compares to the usual ways Indians access foreign markets:

| Feature | GIFT City Route | LRS/Direct Overseas | International MFs in India |

|---|---|---|---|

| Single-window Access | Yes | No | No |

| Jurisdiction Simplicity | High | Low | Medium |

| Transaction Taxes | Waived | Standard | Standard |

| Regulatory Oversight | IFSCA (Indian authority) | Foreign | SEBI |

| Minimum Investment | Variable (can be high for some funds) | Flexible | Low |

| Support/Platforms | Growing, digital-first | Varies | Established |

Who Uses GIFT City?

- NRIs looking for easier access to Indian and global instruments.

- Resident Indians wanting to invest outside traditional mutual funds.

- Even institutions aiming for better global diversification.

Is GIFT City for You? Here’s Your Self-Assessment Toolkit

Not every investment route fits everyone—so here’s a practical, zero-nonsense way to figure out if GIFT City could make sense for you. Remember, this is not financial advice; these are simply helpful tools and facts.

Checklist: Will GIFT City Fit Your Goals?

Ask yourself:

- Am I looking to diversify my portfolio with global investments that go beyond what Indian mutual funds offer?

- Would I benefit from unified access to both Indian and global products from a single account?

- Am I comfortable completing digital KYC and operating through online platforms?

- Can I handle investing sums that may be higher than traditional mutual funds (some GIFT City options have minimums)?

- Do I value possible cost savings from reduced transaction taxes and fees?

- Am I willing to learn a bit about changing tax rules and compliance?

- Would I like more control over foreign currency exposure and investment options?

- Am I comfortable managing my own research and, when required, consulting registered experts on tricky situations?

Tip: If you answered “yes” to several questions above, GIFT City could be worth exploring further.

| Myth | Fact |

|---|---|

| Only NRIs can invest through GIFT City. | Resident Indians can also invest in certain products via approved routes and LRS rules. |

| GIFT City is only for the super-rich/HNIs. | Some products have high minimums, but newer retail-focused funds are emerging. |

| It’s always tax-free for Indians. | Tax structure is nuanced; transaction taxes are waived but income/capital gains are taxed. |

| Platforms are hard to access or unreliable. | Leading Indian brokers now offer digital-first access and customer support. |

| Compliance is automatic and easy. | Some steps—like annual reporting/tax filings—remain the investor’s responsibility. |

What to Research Next

- Broker List: Visit the official IFSCA or SEBI websites for up-to-date, registered broker/platform lists.

- Fee Check: Compare trading/account fees across platforms before opening an account.

- Compliance Updates: Bookmark RBI and IFSCA updates for the latest on LRS rules, TCS thresholds, and annual limits.

- Documentation: Prepare digital versions of your PAN, Aadhaar/passport, bank details, and proof of address for onboarding.

- When in Doubt: For anything complex (inheritance, repatriation, tax), seek help from a SEBI-registered investment advisor.

Real Benefits—Why GIFT City Makes Investing Easier

Here’s how GIFT City stands out beyond the buzz—what you can really gain, and why so many Indians (not just NRIs) are considering it.

All-in-One Platform

With GIFT City, investors can:

- Open a single account for access to Indian AND global markets.

- Trade US and Indian stocks, ETFs, and derivatives—from one digital dashboard.

- Skip the old mess of opening multiple foreign accounts or wrestling with global paperwork.

Tax and Cost Advantages

- No securities transaction tax (STT): Unlike regular Indian equity/futures transactions.

- No stamp duty or commodity transaction tax: More savings on high-frequency or larger trades.

- Unified currency management: Potential for cost savings on foreign currency conversions.

- Greater transparency: Most GIFT City platforms show fees and taxes upfront.

Example: Active traders could save thousands each year just on waived transaction fees alone—always compare direct costs before you start.

What You Get: Indian and Global Choices

- Mutual Funds (India and Overseas), Global ETFs, US & international stocks: All accessible via select brokers.

- Special products like GIFT Nifty (derivatives) and Unsponsored Depository Receipts (UDRs): Broader investment menu than standard Indian platforms.

- Growing ecosystem: Several reputed Indian brokers are rapidly adding support and features—making access easier each year.

Tip: Always check the latest platform lists and user reviews—new offerings are launched regularly, often at lower minimums than before.

The Realities—Risks, Limitations, and Fine Print

While GIFT City opens doors, it’s vital to be aware of what can go wrong or slow you down. Here’s what savvy Indian investors should keep in mind:

Challenges and Caveats

- Eligibility and Access

Not every broker or fund is available to all users. Some retail-friendly funds exist, but many offerings cater to HNIs or require higher minimum investments. - Digital-First Approach

Platforms are largely online and digital—great for convenience, but potentially challenging if you prefer face-to-face service. - Changing Rules and Limits

LRS (Liberalised Remittance Scheme) rules, annual limits, and product availability may shift—RBI, SEBI, or IFSCA announcements can affect your options. - Platform Variety

Service quality, trading experience, and mobile app support vary widely by broker. It’s smart to review and compare before choosing.

Hidden Costs and Regulatory Nuances

- Currency Conversion Charges

Converting rupees to dollars (or other currencies) for investing may come with exchange markups—always check the rate your broker/platform offers. - Account-Opening and Maintenance Fees

Fees can include KYC setup, account maintenance, platform access, and brokerage per trade—ask for a full fee breakdown upfront. - Customer Service and Dispute Resolution

Some international transactions/settlements may have longer resolution times, and on-the-ground support in GIFT City is still developing. - Reporting and Tax Filing

You’re responsible for year-end disclosure of investments, capital gains/loss, and foreign assets as per Indian income tax laws.

When to Get Expert Help

Some situations genuinely benefit from a registered professional. Consider consulting a SEBI-registered investment advisor or tax expert if you’re:

- Unsure how LRS/TCS rules apply to your plans.

- Dealing with inheritance, joint accounts, or large transactions.

- Confused about international compliance, doubly so if you’re an NRI.

Always prioritize official guidance—the ecosystem is fast-evolving.

Getting Started Made Simple—A Step-by-Step Guide

Ready to give GIFT City a try? Here’s a straightforward roadmap for you if you’re interested in jumping in smartly and safely.

How to Open an Account

- Research and Shortlist Platforms

— Visit the official IFSCA website for a list of licensed brokers and platforms.

— Check independent reviews and feature comparisons. - Gather Documents

— PAN, Aadhaar or valid passport, proof of address, bank account details. - Complete Digital KYC Process

— Most brokers offer seamless digital onboarding. - Understand LRS Rules (for Residents)

— Check your eligibility and yearly limits (typically USD 250,000 per person), and keep TCS (tax collected at source) in mind for larger transfers. - Fund Your Account

— Transfer funds as per platform guidance; confirm currency conversion rates. - Explore Investment Options

— Mutual funds, ETFs, US/global stocks, UDRs—review available products and minimum ticket sizes. - Track and Report

— Maintain records of investments, withdrawals, and all regulatory documents for your convenience and tax reporting.

Checklist: Questions to Ask Your Platform/Broker

- What investment options are open to resident Indians, NRIs, and HNIs?

- What are all the fees—account opening, trading, maintenance, and conversion charges?

- What kind of support is available—phone, email, or in-person?

- How is reporting/tax filing support handled?

- Are there any platform quirks or transaction limits I should know about?

- How smoothly does repatriation (sending money back to India) work?

Key Resources for Updates and Rules

- IFSCA official site

- SEBI website

- RBI’s LRS page and latest circulars

- Current broker/platform “FAQs” and helpdesks

Always verify information with the latest primary sources before taking action.

Your Next Steps Toward Global Investing

GIFT City is opening the doors for Indians to invest in global markets with greater ease, fewer hurdles, and smarter tax management than before. But as with any financial decision, what works best depends on your unique goals, comfort with digital platforms, and willingness to stay informed about changing rules.

Use the tools and checklists in this guide as your starting point. Bookmark key resources, ask essential questions, and remember—well-researched choices lead to greater confidence and long-term gains. Share this guide with friends, and take your first step toward stress-free global investing with clarity, not confusion!

Disclaimer : This article is for educational purposes only and does not constitute investment, legal, or tax advice. Readers should consult registered financial or tax professionals before making any investment decisions and always verify details with official sources, as rules and offerings may change over time.